Govt set to scrap VAT hikes on mobile bills, medicines, restaurants

DailySun || Shining BD

The interim government has decided to avoid hiking VATs on mobile bills, medicines and restaurants, according to National Board of Revenue (NBR) member Mohammad Belal Hossain and the organisation’s Second Secretary Barrister Md Badruzzaman Munshi.

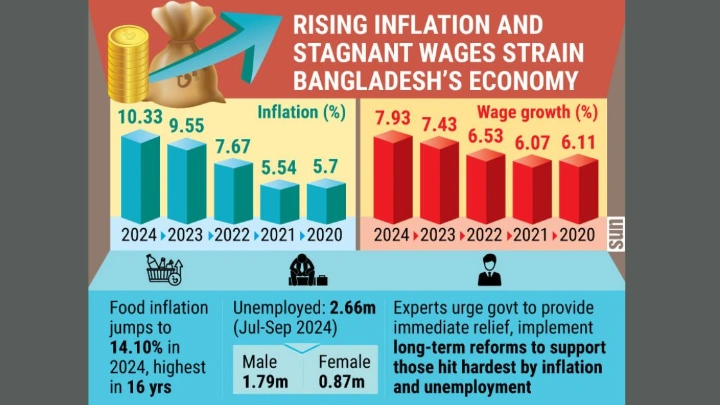

To avoid harming the interests of low-income earners, the government has decided to scrap the plans

A notification in this regard will be issued Thursday, NBR officials said.

Under the new decision, VAT on restaurants will be retained at 5%. On 9 January, the government decided to hike the VAT for eating at restaurants to 15%, for medicines to 3% from 2.4% at the production stage, and for mobile use to 23% from 20%.

The hikes were planned to unlock a tranche of IMF’s $4.7 billion bailout package. The IMF has set a condition to raise the tax-GDP ratio to 2% by means of duty hikes.

Protesting the tax hikes, restaurant owners called for forming a human chain on Thursday. Drug companies also notified the government that the duty hikes on medicines would hike health care costs for all income groups.

Shining BD