Stagflation: A growing crisis in Bangladesh

DailySun || Shining BD

Three years ago, Osman Goni, 45, from Darussalam, Dhaka, was able to support his family on a monthly income of Tk15,000. However, with the increasing cost of living, particularly in food and basic commodities, his family’s expenses have ballooned to Tk30,000–Tk35,000 a month. Despite his best efforts, Osman’s income has not increased proportionally, forcing him to borrow Tk5,000 to Tk10,000 monthly just to make ends meet.

“Sometimes, I cry unknowingly. We can live without eating, but we can’t let our children go hungry,” he confides, capturing the emotional toll this economic pressure has had on his life.

Osman’s struggle is shared by many across Bangladesh, where inflation has surged while wages remain stagnant. Rising food prices and economic stagnation have left lower- and middle-income families grappling with mounting debts and difficult choices.

Jafor, 35, a private sector employee, faces a similar crisis. Once able to manage his household on his salary, he now struggles with expenses that have doubled. To cope, Jafor supplements his income by driving an auto-rickshaw at night. Recently, he took a loan to buy a motorcycle and started working with Uber and Pathao to make ends meet.

“Even with the extra work, I still struggle to cover my expenses,” he admits, illustrating the lengths people are going to in order to stay afloat.

Inflation crisis in Bangladesh

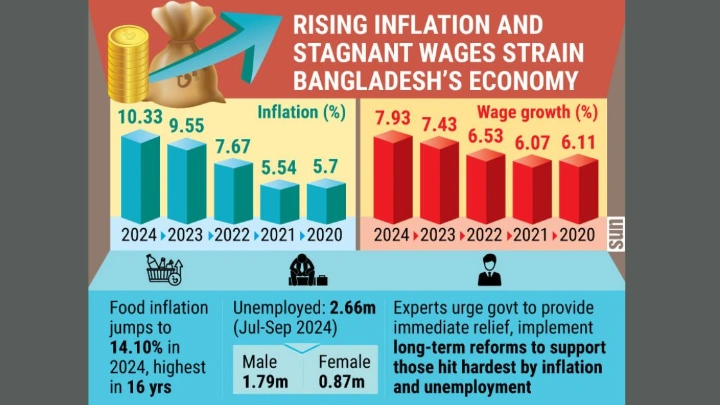

In 2024, Bangladesh grappled with soaring inflation, averaging 10.33%, far outpacing the 7.94% wage growth. Over the past three years, inflation has consistently risen at double the rate of wages. In 2023, inflation reached 9.55%, while wages increased by just 7.43%.

Data from the Bangladesh Bureau of Statistics (BBS) highlights this growing disparity. In 2021, inflation was 5.54% against a 6.07% wage growth. By 2024, food inflation alone surged to 14.10%, marking a 16-year high and making it one of the hardest years for consumers.

While the official inflation rate initially seemed below 10%, new data revealed it had climbed to 11.66% by July 2024. Despite government reassurances, the harsh reality left many citizens struggling to afford basic necessities.

Unemployment on the rise

Unemployment in Bangladesh has become a growing concern alongside inflation. According to BBS data, the unemployment rate rose to 4.49% in the July-September quarter of 2024, up from 4.07% in the same period the previous year.

Female unemployment increased significantly, reaching 7.16% from 6.15%, while male unemployment rose slightly from 3.46% to 3.81%. A total of 2.66 million people were unemployed in the third quarter of 2024, 170,000 more than the previous year.

This increase in unemployment has intensified economic challenges for families, particularly those from low-income backgrounds, fuelling frustration and insecurity across the country.

Government response

The government has faced criticism for its handling of the economic crisis.

Dr Zahid Hussain, former lead economist at the World Bank’s Dhaka office, said, “People are suffering under inflation. Wages remain stagnant while prices rise. The government must provide more support for those struggling.”

Criticising the suspension of subsidised goods sales through the Trading Corporation of Bangladesh (TCB), the economist said, “Halting this service without alternatives is not the solution.”

Critics have also highlighted the government’s decision to increase allowances for public officials while ordinary citizens face economic hardship.

Dr Hussain warned that political instability is deterring investment, saying, “Investors seek stability, and uncertainty discourages them. The government must prioritise economic stability and job market support.”

Finance Adviser Salehuddin Ahmed pointed to market manipulation and supply chain disruptions as key drivers of inflation, with VAT adjustments on products like mobile phones and imported fruit juices playing a minimal role.

“Market disruptions are the primary cause of price hikes,” he said.

Planning Adviser Dr Wahiduddin Mahmud acknowledged that controlling inflation is the country’s biggest challenge.

“Reducing inflation is not easy, but efforts are being made. For example, stabilising potato prices alone could significantly impact inflation rates,” he said.

The path forward

Amid the ongoing economic crisis, experts are urging the government to take immediate and effective action to support those hardest hit.

Dr Zahid Hussain emphasised the need to increase budget allocations for individuals struggling with unemployment and inflation, saying, “The government must find ways to ease their burden.”

While long-term reforms are essential to address inflation, wage stagnation, and unemployment, the immediate focus should be on alleviating the impact of rising living costs on vulnerable populations. Many citizens continue to hope for relief and a return to economic stability.

Shining BD