Curbing inflation or spurring growth?

DailySun || Shining BD

Since the interim government assumed office following the ouster of the fascist Awami League government, it has taken a number of significant measures, including hiking the policy rate, to tame inflation and boost the economy, but these steps have not yet markedly improved the condition.

In this situation, entrepreneurs as well as economists are keenly observing what measures the Bangladesh Bank will take in its upcoming monetary policy for the second half (January-June) of the current fiscal year to curb inflation and boost investments.

Traders, economists and bankers all agree that initiatives like hiking interest rates are necessary to shrink inflation, but they have expressed their fear that raising the policy rate further will put more strain on traders as well as on consumers by significantly impacting credit growth and consumption.

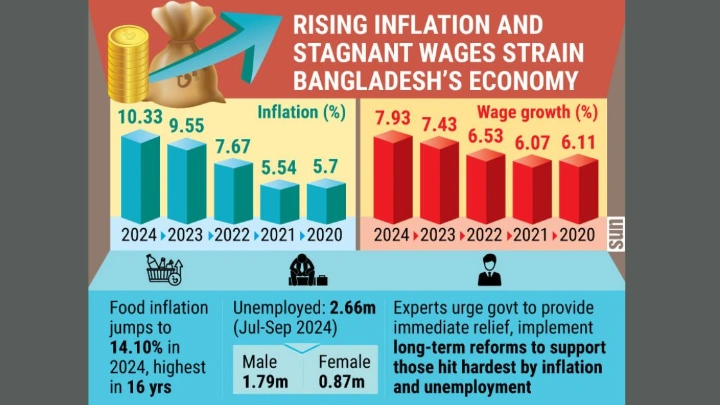

Since Dr Ahsan H Mansur took office as the Bangladesh Bank’s new governor on 14 August 2024, the central bank increased policy rate thrice, by 50 basis points each time, over the past five months, which currently stands at 10%. However, despite these rate hikes, inflation has not dropped much, as it hovered around 10.89% in December 2024.

In May 2022, the policy interest rate was 5%. Since then, the rate has increased 11 times.

Meanwhile, private sector credit growth in November 2024, a key factor for investment, hit the lowest – 7.66% – in around 3.5 years.

At the same time, imports of intermediate goods and capital equipment have also dropped. The number of LC settlements for capital machinery imports has decreased by 13% in the July-November period of 2024, compared to the previous year.

While the policy rate hike failed to tame inflation, it drove up the interest rates on all types of loans in the market. As a result, the demand for loans in the private sector has dropped to its lowest point, which experts believe will have a significant negative impact on the economy in the long term.

Husne Ara Shikha, spokesperson and executive director of Bangladesh Bank, said that the central bank has adopted a contractionary monetary policy to control inflation, which has involved frequent changes in the policy rate. As a result, the interbank interest rates have risen. However, she said, the interest rate will drop when inflation is controlled.

Shams Mahmud, president of the Bangladesh Thai Chamber of Commerce and Industry told the Daily Sun, “Raising the policy rate again will not only hinder new investments, it will also be a disaster for businesses. In developed countries, it is possible to control inflation by raising interest

rates because 90% of the loans are consumer loans. As a result, raising interest rates can reduce consumption there.

“In our country, however, 85% of loans are for business purposes. Therefore, raising interest rates cannot control inflation here, as evidenced by government data. It is nearly impossible to do business with loans at 15% interest. If this situation continues, achieving the SDG graduation will not be possible.”

He proposed different interest rates for business and consumer loans.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told the Daily Sun, “The aim of increasing the policy interest rate is not being achieved. VAT is being increased along with the policy interest rate. Inflation will not drop if the policy interest rate and VAT are increased at the same time. This will disrupt people’s lives.

“We need to move forward through a combination of monetary policy, fiscal policy and market management. Otherwise, simply increasing the policy interest rate will have a negative impact on investment. This will affect growth, employment and overall economic stability.”

The monetary policy for the second half of the current fiscal year 2025-26 will be announced in the last week of this month.

Meanwhile, the Bangladesh Bank has already started discussions with various stakeholders. This will be the current governor’s first monetary policy announcement.

When asked why inflation cannot be controlled by raising the policy rate, a senior official of the Bangladesh Bank said it is not entirely correct to say that inflation is not being controlled by raising the policy rate. He pointed out that inflation did decrease slightly in December due to the most recent hike in the policy rate in October.

He explained, “Our country is already weak, and on top of that, there are various pressures. As a result of the increase in the policy rate, loan interest rates have risen. Now, it is also being said that gas prices will be increased again. If gas and electricity prices are raised along with the policy rate, it will be impossible to control inflation.”

Shining BD