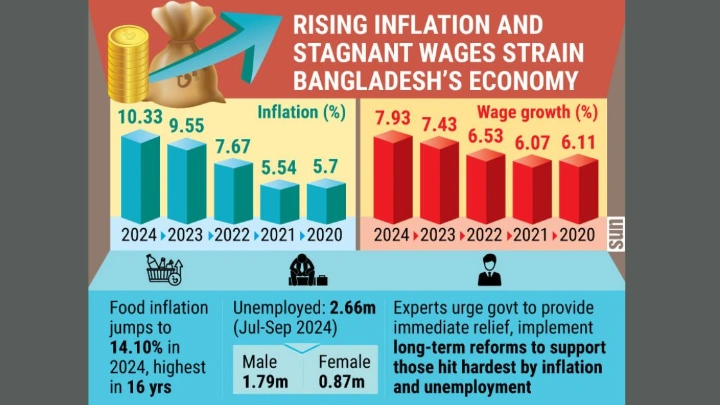

Another forex volatility feared

DailySun || Shining BD

Repeated moves by the central bank to rein in foreign currency market manipulators has failed to provide adequate relief over the course of history, and the moves taken during the interim government would simply continue the trend, industrialists have cautioned.

According to the latest Bangladesh Bank decision, from Sunday, the dollar purchase rate would be almost liberalised and left at the mercy of supply-demand dynamics with the central bank functioning only as a moderator.

Though unprecedented in its framework, the scheme is unlikely to shake off the grip of near-hidden price manipulators, raw material importers fear.

Their fears stem from the fact that a series of policy shakeups adopted by the central bank, with veteran economist Ahsan H Mansur at its helm and Chief Adviser Prof Muhammad Yunus as the monitor, has largely proved futile.

Following the fall of pro-syndicate Sheikh Hasina government on 5 August, the restructured Bangladesh Bank authority has fined 10 commercial banks for selling dollar above the government fixed rate, suspended licenses of seven money exchangers, and removed the treasury chiefs of six banks.

Despite all the efforts, the rate of remittance dollar surged to Tk127 last month, up by 47% from Tk86.20 recorded in March 2022. After March 2022, the Ukraine war pushed up the dollar rate and market opportunists have been exploiting the crisis ever since.

In the previous announcement, the central bank fixed remittance dollar purchase rate at Tk123, up from its previous fixed rate of Tk120, and tied the rate with export earnings dollar rate. Wayward banks were also cautioned against causing further market instability, said Bangladesh Bank Spokesperson Husne Ara Shikha at the time.

The forex market has now largely stabilised, according to her. But, production company owners fear the stability won’t last, being exhausted by years of ineffective monetary policy intervention.

Shining BD