Defaulted loans may exceed Tk6 lakh crore

DailySun || Shining BD

Bangladesh Bank spokesperson Husne Ara Shikha has said "Previously, data on defaulted loans was concealed. Now, we are making an effort to disclose all information publicly. Currently, it is estimated that defaulted loans amount to over Tk4 lakh crore. However, once the full data is revealed, this figure could exceed Tk6 lakh crore."

Husne Ara added, "At this moment, we have no intention of underreporting defaulted loans. Once investigations in the banks are completed, we will be able to determine the necessary steps to reduce the amount of defaulted loans."

Speaking at a press conference on Tuesday, she said, "We are trying to follow international rules regarding defaulted loans. This is one reason for the increase. Regardless of the data, we are now disclosing everything."

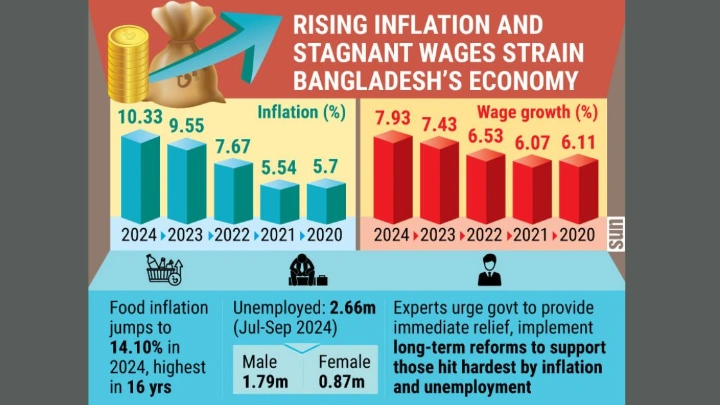

Regarding inflation, Husne Ara said, "We have already raised policy interest rates multiple times to control inflation. We hope inflation will decrease by January. If not, we may consider raising the policy rates again. However, this approach has not been well-received by businesses, as they have to bear higher interest costs on bank loans, which also slows down investments. Therefore, it is crucial for other agencies, in addition to the central bank, to perform their duties effectively.

"Investment is not solely affected by interest rates. Infrastructure development, energy supply, and transportation systems are also closely tied to increased investment. Hence, inflation control cannot be achieved solely through the central bank’s efforts."

In response to journalists’ questions, the spokesperson said, "By the end of 2025, we will have a clearer picture of how much money has been laundered, through which banks, and to which countries. Recovering laundered funds is a time-consuming process. The designated agencies are working on this, but for security reasons, they do not share these details with us."

According to data published by Bangladesh Bank, the private sector loan growth in November 2024 stood at 7.66%, the lowest since May 2021, when it was 7.55%. This growth was below the central bank’s target for the period. Bangladesh Bank had set a loan growth target of 9.8% for the first half (July–December) of the 2024–25 fiscal year.

Shining BD