NBR to expand income tax coverage after VAT hike

DhakaTribune || Shining BD

After the government decided to increase Value Added Tax (VAT) last week, the National Board of Revenue (NBR) has announced measures to expand the scope of income tax as well.

In a press release issued on Saturday, the revenue board said: "Alongside VAT, multifaceted initiatives are being taken to widen the scope of income tax."

The statement further said, "In continuation of gradually moving away from the culture of income tax exemptions, provisions for cancelling or amending such exemptions are currently underway. If revenue is not increased from other sectors, excluding essential goods, a massive budget deficit will arise."

Recently, the interim government decided to increase the VAT rate on 43 products and services to 15%.

Additionally, taxes on items like airfares, cigarettes, medicines, detergents, and soaps are also set to rise.

However, a presidential ordinance regarding these measures has not yet been issued.

The government has also decided to broaden the scope of VAT, meaning businesses with an annual turnover exceeding Tk50 lakh will now fall under the 15% VAT threshold.

In the press release sent to the media on Saturday, the NBR said that several recent media reports on VAT, income tax, and customs duty had come to their attention.

Addressing those reports, the revenue authority clarified that the goods and services subject to higher VAT, supplementary duty, and excise duty do not include essential commodities.

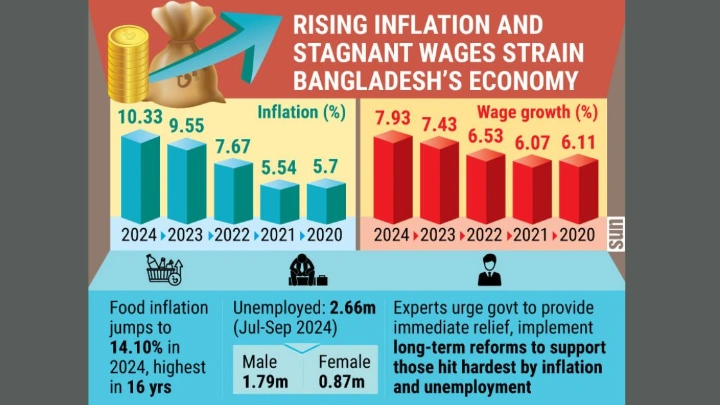

Therefore, there will be no impact on the prices of everyday consumer goods, nor will there be any effect on inflation.

The press release further said that, over the past four months, duties, VAT, and income tax were waived at the import, local, and trading levels for eight items—rice, potatoes, onions, sugar, eggs, dates, edible oil, and pesticides—to ensure adequate market supply and price stability.

This resulted in a significant drop in revenue collection.

The NBR emphasized that if revenue cannot be increased from sectors other than essential goods, a substantial budget deficit will emerge.

As a result, VAT coverage is being expanded.

The NBR is compelled to take these special measures during the midterm of the 2024–25 fiscal year.

Shining BD