Country caught in debt cycle

DailySun || Shining BD

The country relies heavily on borrowing from commercial banks and other sectors to sustain the economy and repay old loans, raising serious concerns about its long-term fiscal health.

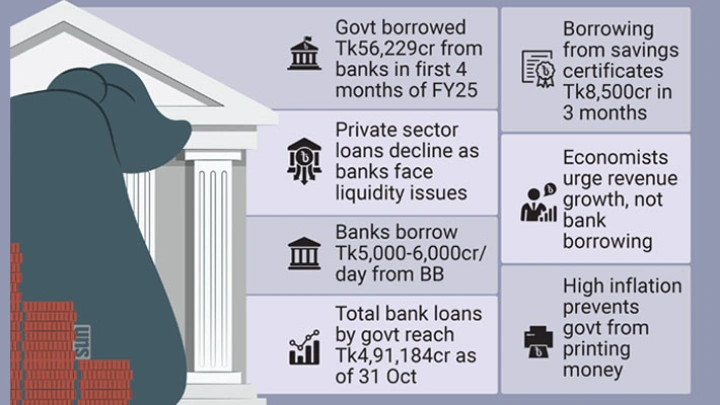

According to Bangladesh Bank data, the government has borrowed Tk56,229 crore from commercial banks in the first four months (July-October) of fiscal year 2024-25.

While it repaid Tk39,533 crore of loans previously taken from Bangladesh Bank, the net bank loan stands at Tk16,695 crore, compared to a negative Tk2,671 crore at the same period last year.

The government’s borrowing came at a time when many banks are struggling with liquidity issues and are themselves borrowing from Bangladesh Bank. Banks are still borrowing Tk5,000 crore to Tk6,000 crore per day on average through repurchase agreements (repo) from the central bank.

Before taking their respective new roles, both Finance Adviser Dr Salehuddin Ahmed and BB Governor Dr Ahsan H Mansur advised the government to increase revenue rather than excessively relying on loans from banks.

However, the interim government continues to meet its expenses by taking loans from both banks and savings bonds even after they hold the key positions in it.

Economists have advised the government to focus on increasing revenue collection rather than depending on borrowing from banks. They pointed out that when the government borrows more from commercial banks, the private sector is deprived of the necessary loans. Therefore, they recommended that the government take as little loan as possible from commercial banks.

Dr AB Mirza Azizul Islam, a senior economist and the finance adviser to the previous caretaker government, said most commercial banks are facing liquidity issues. “If the government continues to borrow excessively, it’ll hurt the private sector. This will lead to reduced investment and with less investment, there’ll be fewer job opportunities, which will put pressure on growth.”

He advised the government to avoid borrowing more from banks and instead focus on increasing revenue, emphasising that this should be done by broadening the tax base rather than raising tax rates.

A senior BB official also echoed similar concerns, saying while banks are benefiting from higher interest rates on loans, the private sector is facing increasing pressure. “As a result, the private sector loan growth is slowing down. Had the government borrowed less from banks, the private sector would have been in a stronger position.”

However, since the government’s income is low compared to its expenditure, it continues to borrow from the banking system. Despite this, the borrowing rate is still within the target.

To meet the budget deficit for the current fiscal year, the government has set a target to borrow Tk1,37,500 crore from the banking sector.

Govt borrowing from banks, savings certificates increases

According to BB data, as of 31 October, the government’s total outstanding bank loans stood at Tk4,91,184 crore, up from Tk4,74,489 crore on 30 June. Among the loans, the government’s loan from the central bank has amounted to Tk1,16,514 crore. The amount was Tk1,56,048 crore at the end of June.

However, in the four months up to October, the government’s loan balance from commercial banks has reached Tk3,74,670 crore, which was Tk3,18,441 crore as of last June.

This indicates that in the first four months of the current fiscal year, the government’s net bank loan increased by Tk16,695 crore.

Officials from Bangladesh Bank have stated that due to lower-than-expected revenue collection and the absence of the desired foreign loans, the government is focusing on domestic sources, primarily banks, to cover the deficit.

In addition to bank loans, the government is increasing its borrowing from savings certificates. In the first three months of this fiscal year, the government has borrowed nearly Tk8,500 crore from this source.

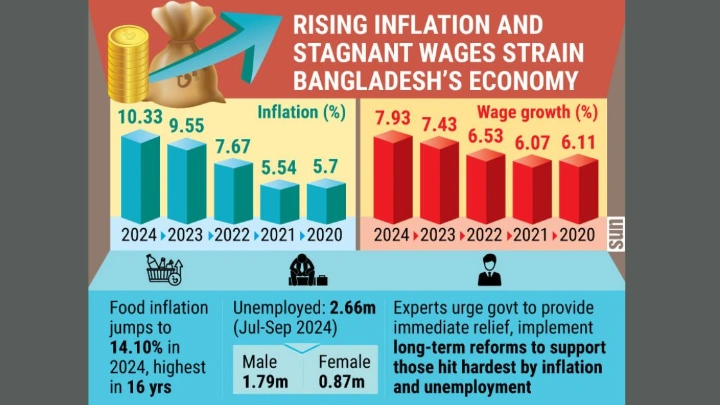

However, due to an inflation rate of around 10%, the government has refrained from printing money through the central bank to finance its loans. In this context, the new BB governor has recently said the excessive borrowing from the banking system would negatively impact the private sector, which is a natural consequence.

He urged the government not to take excessive loans from the banking sector.

According to the National Board of Revenue (NBR), the revenue target for the current fiscal year has been set at Tk4,30,000 crore. This means the government needs to collect around Tk35,833 crore each month. However, in the first three months (July-September) of the fiscal year, there has been a shortfall of Tk25,597 crore in customs and tax collection. In none of these months, the NBR met its revenue collection target. According to NBR’s data, the total revenue target for the period was Tk96,500 crore, but only Tk70,903 crore was collected, resulting in a shortfall of Tk25,597 crore.

Borrowing from banks affects private sector’s loan growth

The government’s increased borrowing from banks has led to a decline in private sector loan growth for much of the previous 2023-24 fiscal year. This trend has continued into the current fiscal year as well. Bangladesh Bank’s data showed that the growth dropped to 9.86% in August from 10.13% in July.

Data shows August’s credit growth was the lowest in the last 11 months. Earlier in September 2023, the growth was 9.69%.

Entrepreneurs argue that the businesses have stalled due to curfews and violent incidents related to student protests, disrupting the normal supply of food products and raw materials in July and August.

Shams Mahmud, president of the Bangladesh Thai Chamber of Commerce and Industry, told the Daily Sun that businesses have been under pressure since July.

Then there was a disruption to the communication system. Banks were also closed at that time. It has directly affected import and export. In the monetary policy statement (MPS) for the first half (July-December) of FY25, the Bangladesh bank lowered the private sector credit growth to 9.8%, down from January-June’s 10% to reduce the credit flow for tackling inflation.

Shining BD