Why savings certificate sales are rising amid the crisis

DailySun || Shining BD

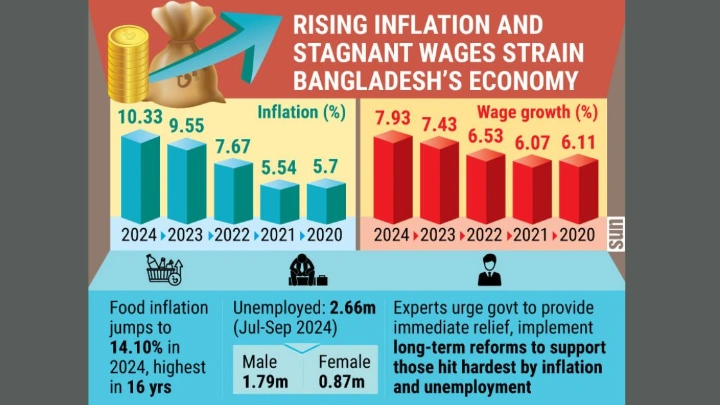

Amid high inflation, people in Bangladesh are finding it increasingly difficult to save, with many feeling the pinch of rising costs. The Bangladesh Bureau of Statistics reports that the country’s inflation rate is 9.92%, while food inflation has soared to 10.40%, making it even harder for households to manage their expenses.

But what’s surprising is that there has been an unusual spike in the sale of savings certificates.

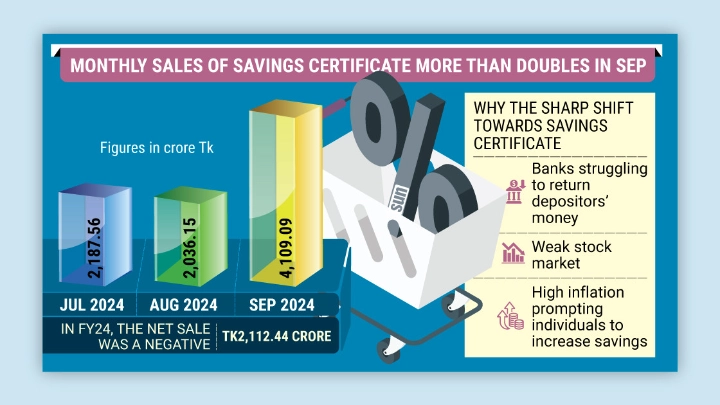

Bangladesh Bank data reveals a dramatic shift: while the net sale of savings certificates was negative by Tk2,112.44 crore in FY2023-24, the current fiscal year (FY2024-25) tells a different story.

In just the first three months (July-September), the net sale of these certificates has surged to over Tk8,332 crore. This rising trend continued through September, prompting speculation about what’s driving the demand for these savings instruments.

Experts suggest several factors may explain the shift. Zahid Hussain, former lead economist of the World Bank’s Dhaka office, noted that while inflation has strained many financially, it has also created investment opportunities for others.

AB Mirza Azizul Islam, an economist and former adviser to a caretaker government, pointed to changing preferences among investors.

He attributes the increase in savings certificate purchases to a combination of factors, including rising remittance flows, a lack of confidence in traditional banks, and a prolonged slump in the capital market.

Net sales

In the first and second months of the current fiscal year, July and August, the net sale of savings certificates was Tk2,187.56 crore and Tk2,036.15 crore respectively. In the third month, September, the net sales nearly doubled the combined sales of July and August, reaching Tk4,109.09 crore.

People are buying savings certificates from the Gulistan office of the Savings Directorate, post offices and various banks across the country. Crowds of people have increased in those places as well.

Savings certificates can be purchased on the ground floor of the Bangladesh Bank’s head office in Dhaka’s Motijheel.

Shahidur Rahman said at present keeping money in a bank is not secured because some banks are not able to return customers' deposits.

Momtaz Hossain expressed his intent to invest in a savings certificate, stating that it offers a secure option for saving money.

He also said the interim government has introduced new benefits in savings certificates and bonds.

Both local investors and expatriate Bangladeshi investors will be eligible to enjoy these advantages.

Another customer Fahmida Rahman told, interested in a family savings certificate, cited concerns about the safety of keeping money in a bank amidst various rumours.

Reasons behind the rise in interest

Economist AB Mirza Azizul Islam cites some primary reasons for the recent increase in savings certificate sales. Speaking to the Daily Sun, he explained, "The banking sector is in poor condition. Many banks are struggling to return depositors’ funds. Even though deposit interest rates have risen, public trust in banks has diminished. People now prefer risk-free savings certificates for whatever amount they manage to save."

He added, “The second reason is the weak stock market, which has been down for a long period with no signs of recovery. Many anticipated improvement with the new government, but that hasn’t materialised. As a result, people are shifting towards savings certificates.”

Islam also noted that rising remittances have played a role in driving up savings certificate investments. "A portion of remittances is typically allocated to savings certificates. Those receiving remittances from abroad often invest what remains after covering essential expenses."

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, observed that political unrest over the last six months has impacted all sectors of the economy, leading many to withdraw bank deposits to cover living costs. However, high inflation has inadvertently funneled more money into the market, enabling some to accumulate savings. This has fueled an interest in bonds, reshaping investment patterns in the financial landscape.

In FY2022-23, the government could not secure loans through savings certificates, prompting a reduced loan target of Tk18,000 crore from this source in the FY2023-24 budget to address the deficit.

However, instead of borrowing, the government had to pay Tk21,124.38 crore from the treasury for interest and principal to customers. For the current FY2024-25 fiscal year, the government set a target to borrow Tk15,400 crore from savings certificates in the budget.

The term “net sales” refers to what remains after paying the real interest on previously sold savings bonds. This money is deposited in the government’s treasury and is used for various state programmes. In return, savings certificate holders are paid monthly interest. Economically speaking, the net sale of savings bonds is considered a form of government “debt”.

Shining BD