S Alam’s grip on Islami Bank ends as govt takes over

DhakaTribune || Shining BD

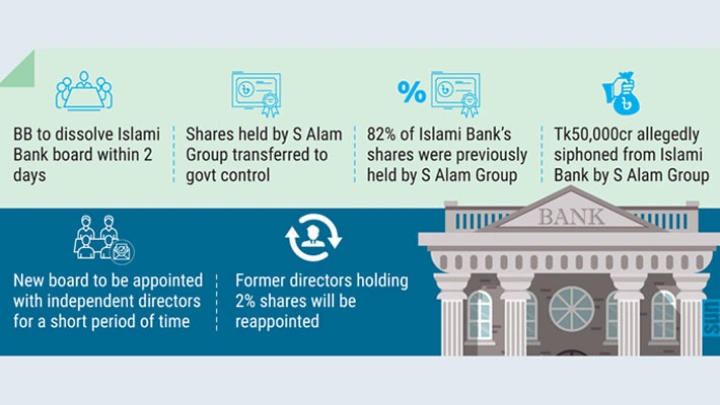

In a move to address allegations of widespread corruption and mismanagement, the Bangladesh Bank has decided to dissolve the board of Islami Bank and take over all shares held by S Alam Group in the country’s largest Shariah-based financial institution against its liabilities as per law.

The decision follows years of concerns about the bank’s operations since it was taken over by S Alam Group in 2017. The Chattogram-based business conglomerate has allegedly siphoned off at least Tk50,000 crore from the bank through various fraudulent schemes over the past seven years, leaving the institution on the brink of financial collapse.

Bank officials have revealed that 82% of the bank’s shares are held by individuals with vested interests in S Alam Group.

Against such a backdrop, the Bangladesh Bank (BB) has decided to dissolve the board of Islami Bank within a couple of days and will form a new board, said Bangladesh Bank Governor Ahsan H Mansur at a press conference on Wednesday.

The governor also said that all shares under the control of S Alam Group will now be under the government’s control.

The shares will be released to S Alam if they can repay the bank loan. S Alam’s liabilities will be adjusted if the loan is not repaid by selling the shares.

The board will be dissolved and independent directors will be appointed for a short period of time. Subsequently, former directors holding 2% of share capital will be taken on the board.

The disclosure comes amid unrest in the largest Shariah-based bank in Bangladesh following the fall of the autocratic Sheikh Hasina regime, which reportedly heavily favoured S Alam Group, on 5 August this year.

Protestors demanded a restructuring of the board and removal of the top management of Islami Bank, which was taken over by S Alam Group Chairman Mohammed Saiful Alam, his family members and the group’s associated entities under the patronage of the previous Awami League government seven years ago.

Asked if boards of all banks under S Alam Group’s control would be dissolved, Ahsan H Mansur said, “We are not in such a rush. A decision will be made about the boards of these banks gradually.”

The governor also said, “Those who have taken money from the bank and have not returned it will not be given any leniency. All legal measures available to recover the funds will be pursued.

The boards of directors of weak banks will be dissolved. The board of National Bank has already been dissolved. Decisions have been made regarding Islami Bank. The same decisions will apply to other banks as well.”

In response to the question of who will manage the banks where the boards are being dissolved, the governor stated that the government will not take over any bank’s management.

“For now, the banks will be run by independent directors. Those who hold more than 2% of the shares, excluding S Alam Group, will be able to join the board later.”

At the press conference, journalists questioned the accountability of central bank officials regarding loan irregularities in various banks. In response, the governor said, “These issues occurred before my arrival. I do not want any disorderly situation to arise in the future. If anyone has any concerns, my door is open. If I find the claims reasonable, I will try to address them. However, it is not possible for me to accept unreasonable demands. If necessary, I will resign. But it is not in my nature to sign anything under unreasonable demands; my resignation will go hand in hand with such signatures.”

Regarding the corrupt officials of the Bangladesh Bank, the governor said, “I will not comment on this matter at the moment. However, we are working on restructuring to ensure that no vested interest group remains in the same position for an extended period.”

When asked about the timeline for addressing financial scandals in various banks, Ahsan H Mansur replied, “This is not a one-day matter. I do not want to create major upheaval immediately because we have a lot of work ahead.”

The central bank governor said, “Our primary task now is to protect the country’s economy. We must take swift action to ensure that Bangladesh does not become a defaulter. We need to address various issues to prevent any questions about our foreign transactions, avoid downgrades, and improve relationships with associate banks.”

82% of Islami Bank shares controlled by S Alam Group

Sources at various levels of Islami Bank have revealed that after S Alam Group took control of the bank in 2017, preparations began to siphon off money under various names. To facilitate this, those who previously held important positions were removed. Simultaneously, S Alam Group established a loyal faction within the bank.

Loyalists were placed in all key departments at the head office and in major branches in Dhaka and Chattogram.

The S Alam Group has not only been involved in loan fraud or irregularities in promotions at Islami Bank. According to the Bank Company Act, a single person, family, or group can own a maximum of 10% of the shares in a bank. After taking control of Islami Bank, the S Alam Group acquired ownership of 131,89,12,165 shares under the names of 24 different entities, which accounts for 81.92% of the bank’s total shares.

Since S Alam Group took control of Islami Bank, nearly 10,000 employees have been recruited over the past seven years. These employees are no longer being allowed entry into the bank.

In 2017, Islami Bank had 13,760 employees across 332 branches, averaging 37 employees per branch. By the end of 2023, with 394 branches, the total number of employees had increased to 20,809, raising the average number of employees per branch to 47.

Shining BD