Finance Minister Abul Hassan Mahmood Ali places Tk 7.97 lakh crore budget for FY25 tomorrow

BSS || Shining BD

Finance Minister Abul Hassan Mahmood Ali is set to unveil a proposed Taka 7,96,900 crore national budget for the next fiscal year (FY25) at Jatiya Sangsad (JS) tomorrow.

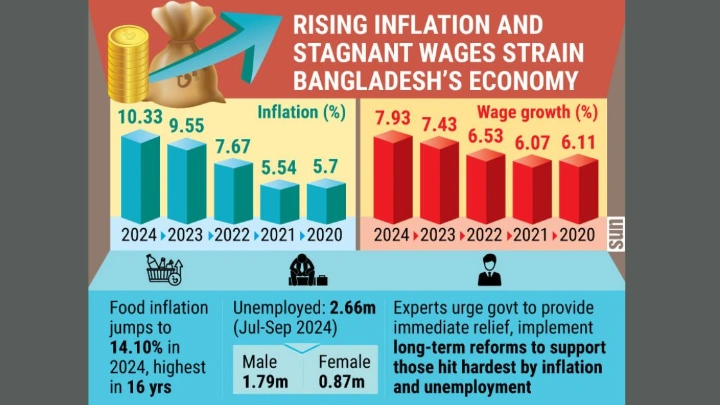

He will announce the budget amid the growing challenges of containing inflation, maintaining a sound foreign currency reserve, a stable exchange rate and generating more revenues.

This will be the country's 53rd budget and the 25th of the Awami League (AL) government in six terms.

Tajuddin Ahmad presented the country's first budget as finance minister of the post-independence Bangabandhu government in 1972.

This budget for FY25 will be the maiden budget of incumbent Finance Minister AH Mahmood Ali.

Career diplomat Ali, who previously served the Cabinet as the Minister for Disaster Management and Relief and the Minister for Foreign Affairs, would eye building a 'Smart Bangladesh' despite various obstacles and adversities.

The Theme of the budget for the next fiscal year would be "Pledge towards building a happy, prosperous, developed and smart Bangladesh" in pursuit of turning the country's economy into its previous sound state.

Amid the global volatile condition and adversities, the finance minister is eying a 6.75 percent GDP growth while containing the inflation at 6.50 percent although the general point to point inflation is still hovering slightly below the double digit mark albeit various efforts from the government to tame inflation.

Finance ministry officials said the possible budget size of Taka 7,96,900 crore would be 4.60 percent or likely around Taka 35,115 crore higher than the budget of the outgoing fiscal year (FY24).

Apart from already approved Annual Development Programme (ADP) outlay of Taka 2,65,000 crore, the possible budget will see an estimated deficit of Taka 2,57,000 crore including grants.

As the government wants to lower expenses, it is likely to contain the budget deficit to 4.6 percent of gross domestic product in the next fiscal year. The government usually keeps the budget deficit at around 5 percent.

In the current fiscal year (FY24), the budget deficit is Tk 2,61,785 crore. In the coming one, the amount is likely to be Tk 2,57,000 crore.

The officials said the government this time is neither pursing a high and ambitious growth nor taking fresh mega projects.

Besides, there will be added pressure on repaying principal amounts and interests against foreign loans for which the National Board of Revenue (NBR) would put higher emphasis on generating more revenues.

To face the expenditure pressure, the government will eye realizing overall revenue of Taka 5,41,000 crore of which the revenue board alone would be entrusted with collecting Taka 4,80,000 crore which is Taka 50,000 crore higher than the outgoing fiscal year.

Finance Division officials familiar with the process of budget formulation said that apart from containing inflation, the priorities of the next budget will include returning the economy into its previous stable state, keeping the prices of commodities within the purchasing power of the common people and maintaining decent living standards by citizens.

The fresh budget will see various austerity measures for reining in public expenditure alongside boosting the farm productivity and keeping normal the supply chain.

Besides, steps towards continuous monitoring of markets to contain inflation, increasing the coverage of the social safety nets, measures for automatic adjustment of fuel oil in line with the global market would help put a positive impact on inflation.

The next budget features a good number of initiatives that include ensuring food for all, improvement in food supply system, widening the coverage of the social safety nets, modernizing every village, ensuring digital health and education system, fast track infrastructure projects, facing the climate change impacts and global adversities.

To meet the budgetary expenditure, the government eyes borrowing of around Taka 2.75 lakh crore of which more than Taka 1.50 lakh crore will come from the banking system. Besides, the government will also try to realize $1.17 billon from the foreign sources.

The government will also earmark an allocation of around Taka 1,20,585 crore for subsidies and stimulus alongside Taka 1,08,000 crore for interests payments for local loans and another Taka 20,000 crore as interest payments for foreign loans.

To widen the VAT net, the NBR will beef up its operations to set up EFDs in Dhaka and Chattogram. Besides, in order to detect newer taxpayers, the NBR has a plan to work with the BRTA, DPDC and city corporations in an integrated manner.

The government is also likely to make mandatory submission of e-challans in case of VAT payment of Taka 20 lakh and above while the current ceiling is now Taka 50 lakh. Besides, some 20.26 lakh people will be included afresh in the social safety nets to cushion them from the impact of inflation.

Shining BD