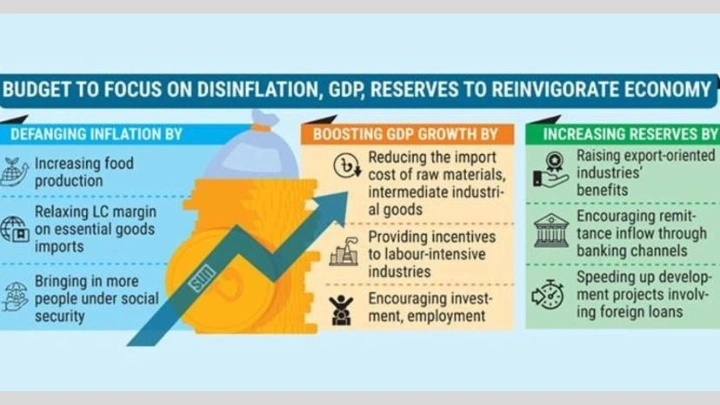

Inflation, debt, growth, reserves, job – top budget priorities

DailySun || Shining BD

The national budget for forthcoming fiscal 2024-25 will focus on reducing inflation and foreign debt repayment pressures by enhancing forex reserves, job opportunities, and GDP by incorporating measures conducive to business and investments, sources at the finance ministry have said.

Recently, in a discussion with journalists, Finance Minister Abul Hassan Mahmood Ali said his main task will be to restore the economy. At the same time, giving relief to common people by controlling inflation is also important. In addition to that, the reserves need to be boosted by increasing the dollar supply.

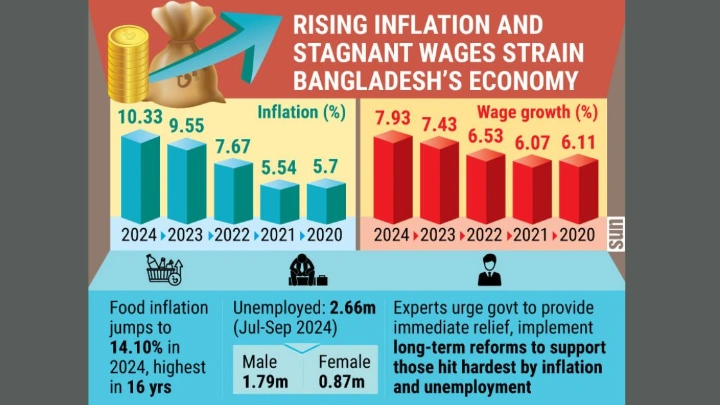

Currently, food inflation is over 10% in the country. The foreign exchange reserves have been plummeting. A slowdown in economic growth has led to stagnation in employment. Besides, revenue collection has not reached the government’s expectation in the outgoing fiscal year. All this bad news is exacerbated by the heavy pressure to repay foreign debts.

In this difficult situation, the finance minister will present the FY25 budget on 6 June.

Dr Mustafa K Mujeri, former chief economist of the Bangladesh Bank, told the Daily Sun that the budget should give a roadmap to restore the country’s economy, uplifting it from its present situation. However, only delineating a roadmap will not be sufficient, its successful implementation will also be necessary. Otherwise, a difficult situation will arise.

Dr MA Razzaque, research director of Policy Research Institute (PRI), said a contractionary monetary policy has to be implemented now at any cost. The Bangladesh Bank must observe and review the new crawling peg system for the dollar rate. The new system will not have a significant effect if the dollar rate for transferring money through hundi still remains higher than the official rate.

“Then we will not be able to control the fall in reserves. The reserve crisis and inflation pressure is a fatal combination of challenges for any policymaker,” he said.

“If the foreign loans to the government are given in the form of budget support, the reserves can be boosted. But if the loan is not used properly, the pressure will increase in debt repayment. So, we should make significant reforms in the economic sector,” he added.

Controlling inflation to be focused The government will give importance to protecting people from price hikes in the upcoming budget. A large number of people, especially the low-income group, have been suffering heavily due to the food inflation rate which hit 10.22% in April this year. The overall inflation rate is over 9.5% now.

The finance minister will highlight measures on inflation control and set a target of 6.5% in FY25.

To stave off the severe effects of inflation, the number of beneficiaries under the social security programmes will be increased by about 5 lakh in the next budget. However, the amount of allowances for this sector will remain unchanged. Besides, the finance minister will highlight reform initiatives to tame inflation to keep locally produced goods’ prices within the general people’s reach, said ministry sources.

The Finance Division sources said the government will also focus more on increasing local food production to control food inflation.

Measures in this regard also include relaxation of LC margin on imports of essential goods under monetary policy. Moreover, the direction of adopting a contractionary monetary policy by increasing the policy rate of the central bank will also be important, said sources.

Encouraging employment essential for GDP growth

According to the Bangladesh Bureau of Statistics (BBS), the unemployment rate has surged to 3.51% in the first quarter (January-March) of this year compared to the last quarter (October-December) of the previous year. The number of unemployed people has increased by around 2.4 lakh to reach 25.9 lakh. To reduce unemployment there will be investment and business expansion initiatives in the budget, said sources.

Creating new jobs is essential to restore the economy as the country’s GDP witnessed a lower growth in the outgoing FY24, compared to the target set for the fiscal year.

Production growth in industry, and agriculture sectors declined in this fiscal due to the general economic recession. However, to become an upper-middle-income country, there is no alternative to increasing production. So increasing job creations is absolutely indispensable in this regard, said experts.

The Finance Division officials said the budget will incorporate initiatives to reduce the import cost of raw materials and intermediate goods for industries, and provide incentives to labour-intensive industries to encourage employment of more people in different sectors.

The GDP growth target will be set at 6.75% for FY25, said sources at the finance ministry.

Budget to stress reserves, revenue, foreign debt repayment

At present, there is a great concern about the foreign exchange reserve deficit. At the end of May this year, foreign exchange reserves in the country stood at $18.72 billion.

So, the budget will have important measures to increase the benefits of export-oriented industries, so they fetch more dollars. The government will also take steps to increase the remittances inflow through banking channels, said sources.

Finance Division officials also said the dollar deficit widened because the private sector paid more than it borrowed when the interest on foreign loans increased.

Due to this, the pressure of foreign debt repayment has increased in the private sector. Besides, currently, a lower amount of private sector loans are coming. As a result, the reserve is decreasing, and causing a financial deficit. If the debt repayment pressure on the private sector eases in the next few months, then the fiscal deficit will also decrease and the situation will improve.

To increase the supply of foreign exchange in the country, the government will also emphasise the implementation of development projects involving foreign loans and grants.

Although the target of revenue collection has increased year after year, the collection picture is disappointing, which hinders budget implementation. So, the government will focus on enhancing revenue collection to implement the budget with ease.

The government is going to set a revenue target of Tk4.8 lakh crore for the forthcoming fiscal 2024-25.

To collect revenue as per the target, the FY25 budget will emphasise on equalisation of VAT in all cases, reduction of corporate tax rate, proposal for abolishing minimum tax in individual sectors, rationalisation of exemptions, and measures to ensure protection of domestic industries.

Shining BD