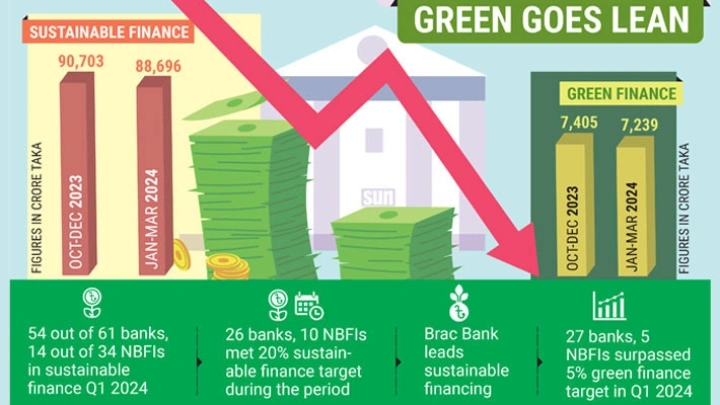

Sustainable financing drops in Jan-Mar quarter

DailySun || Shining BD

Loan disbursements in the sustainable finance sectors have dropped by Tk2,007 crore in the March quarter of 2024 compared the December quarter of the last year.

According to Bangladesh Bank data, the country’s banks and NBFIs distributed a total of Tk88,696 crore in the sustainable finance sectors in the current year’s January-March period, down from Tk90,703 crore disbursed in the October-December quarter of 2023.

Meanwhile, loan disbursements in the green finance sector also plummeted in the March quarter of 2024.

The total loan disbursement in this sector stood at Tk7,239 crore in the January-March period of 2024, which was Tk166 crore less than the disbursement of Tk7,405 crore in the previous quarter.

The Bangladesh Bank introduced green banking activities back in 2009 and issued guidelines on green banking in 2011. Later, it rolled out the sustainable finance policy in 2020.

According to the central bank data, 54 banks out of 61 and 14 NBFIs out of 34 in the country have had exposure in sustainable finance in the March quarter.

Moreover, 26 banks and 10 NBFIs have been able to fulfill their target in sustainable finance, which is 20% of the total loan disbursement.

Brac bank topped the chart when it comes to sustainable financing, followed by Eastern bank City Bank, Jamuna Bank, Exim Bank, Prime Bank, Mutual Trust Bank, Bangladesh Krishi Bank, National Bank and Trust Bank.

During the first quarter of the running year, 27 banks and five NBFIs have surpassed the 5% target of green finance compared to the total term loan disbursement.

Bank Al-Falah, State Bank of India, United Commercial Bank, Shimanto Bank, and Mutual Trust Bank were the top five banks in green financing in the March quarter this year.

The central bank defines sustainable financing as any form of financial service including investment, insurance, banking, accounting, trading, economic and financial advice integrating environmental, social and governance criteria into business or investment decisions for lasting benefits of both clients and society.

Shining BD