The prevalence of obesity has nearly tripled among women and increased by 1.5 times among men in the country over the past 14 years due to sedentary lifestyles and dietary changes.

A healthy step as NBR plans higher tax on sugary foods, beverages

TBS || Shining BD

The National Board of Revenue (NBR) is considering levying higher taxes on food and beverage products that contain added sugar in the forthcoming budget for FY25 – a move applauded by experts as a right step towards promoting public health.

Currently, carbonated beverage manufacturers face a minimum 3% tax on turnover, a rate that may increase to 5% in the next fiscal year, a senior NBR official who is closely engaged in policy-making told TBS, on condition of anonymity.

The increase is expected to be much bigger for sugary food items. The minimum tax rate on cakes, biscuits, chocolates, jams and jellies, juices and ice cream may rise to 5% from the existing 0.6%, the official said.

He hinted at potential increases in supplementary duties for some sugary products as well.

"On Tuesday [14 May], we will sit with the prime minister to finalise our proposal," he added.

While industry insiders are against the move, health experts have embraced it, saying the tax hike would result in price increases, ultimately reducing the consumption of sugary items and reducing health risks.

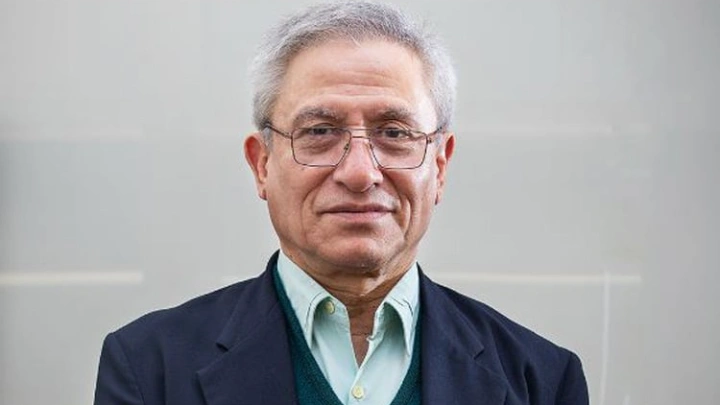

"It would be a good move if the government increases taxes to limit the consumption of sugar-sweetened beverages, as these items are harmful to health," Professor Benazir Ahmed, a public health expert, told TBS.

"Sugar and salt are essentially white poisons, so we should discourage their consumption by any means," he said.

"Sugar-induced items are mostly responsible for metabolic disorders and hyperlipidemia, also known as high cholesterol, which also have adverse effects on the brain and skin. These items directly increase sugar levels in the human body, and insulin fails to regulate them," Benazir explained, adding that the government should promote the availability of natural fruits, which are beneficial for the human body.

According to a study titled "Underweight, overweight or obesity, diabetes, and hypertension in Bangladesh, 2004 to 2018," published on 30 September 2022, the prevalence of obesity has nearly tripled among women and increased by 1.5 times among men in the country over the past 14 years due to sedentary lifestyles and dietary changes.

The study also found that the prevalence of diabetes has been on the rise, increasing from 11% to 14% in both men and women.

Professor Dr Rumana Ahmed, a public health economist, said, "It would be a positive step if the NBR imposes taxes on sugar-sweetened beverages. This measure would serve two purposes: revenue generation and improvement of public health."

In the FY24 budget, the government increased the minimum tax for carbonated beverage manufacturers from 0.6% to 5%.

However, following significant lobbying efforts from various stakeholders, the government eventually reduced it to 3%.

Meanwhile, for other sugary items such as juice, ice cream, chocolate, cake, biscuit, jam, and jelly, the current minimum tax remains at 0.6%.

"Now we plan to raise the minimum tax for all manufacturers of sugary items to 5%," said the NBR official.

"We anticipate minimal revenue growth in this sector, with the possibility of a decrease. Our main objective is not to increase revenue from this sector – rather, to reduce the consumption of sugary products, taking into account health concerns," said the official.

In FY23, the government collected Tk1,482 crore in revenue from this sector. However, following the tax increase in FY24, sales declined, leading to a 30% reduction in revenue from July to March of the current fiscal year.

Businesses push back against the proposal

Industry insiders said a sharp increase in taxes could have a significant negative impact on the sector, potentially resulting in reduced investments.

SM Jahangir Hossain, president of the Bangladesh Beverage Manufacturers Association, told TBS, "If taxes rise, prices will inevitably follow suit, which could dampen consumption. However, we must await the budget announcement to ascertain the government's proposed adjustments."

Md Mahbubul Alam, president of the Federation of Bangladesh Chambers of Commerce and Industry (FBCCI), the country's apex trade body, penned a letter to NBR Chairman Abu Hena Md Rahmatul Muneem on 9 May, urging a reduction in current tax rates.

In that letter, the FBCCI president urged the NBR to implement a sustainable tax framework for the sector to stimulate both domestic and international investments.

According to the Beverage Manufacturers Association, investments in the carbonated beverage sector in Bangladesh amount to around Tk10,000 crore, with a Compound Annual Growth Rate of 20%.

Can consumption be curbed only by hiking taxes?

According to the Bangladesh Beverage Manufacturers Association, with all import taxes, value-added tax, and other taxes, the total tax incidence on carbonated beverages currently exceeds 48%.

According to Business Initiative Leading Development (BUILD) tax on beverage products in India is 40%, Sri Lanka 29%, Nepal 39% and Bhutan 30%.

While experts expressed approval for the proposed tax increase, they said simply raising the tax would not suffice to meet the objective of reducing beverage consumption.

Professor Benazir Ahmed, also a former director of the Directorate General of Health Services (DGHS), said, "There needs to be a massive public awareness campaign to curb sugar-sweetened beverages consumption, especially among children, led by the health department. The government needs to invest significantly to promote healthy food habits."

Referring to tobacco products, he said, "We have seen that tax hikes alone cannot control the consumption of harmful items. We also need to encourage local fruit producers."

Professor Rumana Ahmed said, "While tax is a cost-effective tool, there is a need for mass campaigns, awareness-raising efforts, and policies on advertisement control and packaging."

Global approaches to taxing sugary items

Different countries around the globe have implemented a range of strategies to reduce the consumption of sugary products through taxation.

Leading the efforts are developed nations such as the United Kingdom and France, which have introduced targeted taxes based on the sugar content of beverages.

UAE imposes a 50% tax on any products with added sugar. Emerging economies across Asia are mirroring these tactics to address rising health concerns.

Shining BD