Islamic banking excess liquidity plunges 67% in 2 years

DailySun || Shining BD

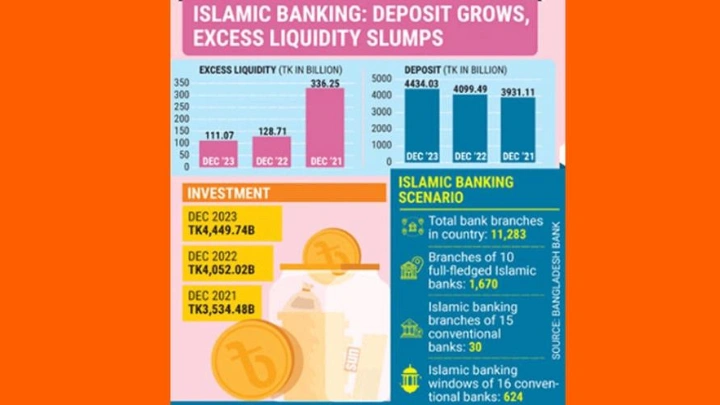

The Shariah-based banks in the country have witnessed a substantial decline in excess liquidity, plummeting by 66.97% over the past two years, according to Bangladesh Bank (BB) data.

Excess liquidity at the Islamic banking system dwindled to Tk111.07 billion by the end of December 2023, a stark reduction from Tk336.25 billion recorded two years prior.

The central bank’s quarterly report on Islamic banking reveals that as of December 2023, the excess liquidity at full-fledged Islamic banks, Islamic banking branches of conventional banks, and Islamic banking windows of conventional banks amounted to Tk73.13 billion, Tk10.24 billion, and Tk27.70 billion, respectively.

Experts attribute this decline in excess liquidity to the limited utilisation of support measures provided by the central bank.

Ahsan H Mansur, executive director of Policy Research Institute, said that the decline in confidence stemmed from ownership changes within Islamic banks, most of which are owned by business groups.

“In the past two years, many clients withdrew their deposits following the exposure of irregularities within these banks,” he stated, referencing instances of loans granted to non-existent entities.

Currently, 10 full-fledged Islamic banks operate with 1,670 branches, comprising a fraction of the total 11,283 branches within the banking system. Additionally, 30 Islamic banking branches of 15 conventional banks and 624 Islamic banking windows of 16 conventional banks offer Islamic financial services.

Salehuddin Ahmed, former governor of the Bangladesh Bank, noted the population’s inclination towards Shariah-based transactions over interest-based ones. However, he emphasised the challenges faced by Shariah-based banks due to various scams and irregularities.

“Many conventional banks are going to Shariah-based banking to survive the challenge of the market competition, because many deposits come voluntarily in Islamic banks. But various scams and irregularities have been found at several Shariah-based banks.”

Excess liquidity is computed after maintaining the required statutory liquidity ratio (SLR) and cash reserve ratio (CRR), with banks mandated to uphold a 4% CRR of total deposits in cash and a 13% SLR in non-cash form at the Bangladesh Bank.

Apart from the liquidity drop, the country’s Islamic banks have managed to demonstrate remarkable resilience even amidst the ongoing economic challenges, experiencing significant growth in both deposits and investments last year.

Deposit, investment grow

Total deposits of Islamic banking system reached to Tk4,434.03 billion at the end of December 2023 with an increase of Tk334.55 billion or 8.16% as compared to the same quarter of 2022.

Among all Islamic banks, Islami Bank received the highest number of deposits 34.72% followed by First Security Islami Bank 10.27%, EXIM Bank 10.10%, Al-Arafah Islami Bank 9.89%, Social Islami 7.80%, Shahjalal Islami Bank 5.63%, Union Bank 5.09%, Standard Bank 4.34%, Global Islami Bank 2.98%, and ICB Islamic Bank 0.28%.

Among different types of deposits of the Islamic banking system, Mudaraba Term Deposits (MTD) secured the highest position 45.86% followed by Mudaraba Savings Deposits (MSD) 19.21%.

Total investment (loans & advances) of Islamic banking system stood at Tk4,449.74 billion at the end of December 2023. Among the 10 full-fledged Islamic banks, Islami Bank Bangladesh affixed the highest investment 33.82% followed by First Security 13.19% and EXIM Bank 10.46%.

In case of the sector-wise investment, Trade and Commerce sector secured the highest position 36.79% followed by large industry 29.79%, CMSMEs (Cottage, micro, small and medium enterprises 9.88%, construction 6.58%, services industry 5.45%.

Shining BD