Top 10 economies to watch in 2023

Shining BD Desk || Shining BD

Everyone knows economists have a poor track record of predicting recessions. Yet, it is hard to ignore the growing consensus among economists that the combination of inflation and interest rate hikes alongside tempered Chinese demand and US economic uncertainty could be the perfect storm for a global recession.

Those same economists, however, disagree on the depth and length of a potential recession as well as the underlying indicators that will answer their questions. Thus, instead of agreeing on a list of indicators, let's focus on some countries that could be bellwethers for changing headwinds in 2023.

Germany: A cold and costly winter, what will summer bring?

A 34.5 billion Euro (USD 36.6 billion) government rescue package for German utility company, Uniper, alongside a 6.3 billion Euro (USD 6.7 billion) rescue package for the former European trading and supply unit of Gazprom, SEFE Securing Energy for Europe GmbH, is a sign of the times. The European Union, which recently approved Germany's nationalisation of the two major gas companies, included a long list of conditions for the rescue packages, which requires both firms to sell off assets and subsidiaries. The two deals are part of the 200 billion Euro (USD 213 billion) German package to support households and companies against rising energy costs and Russia's decision to weaponize energy by cutting off the flow of gas.

German Chancellor Olaf Scholz is confident his country will get through winter without an energy crisis. But the more important question is how Germany confronts the greater economic hurdles over the long term. German leadership will primarily focus on replacing Russian gas and combatting inflation in 2023, but it will also have to rethink trade and economic growth. Russia is gone as a major trading partner for the near term and its other major trade partner, China, is increasingly butting heads with other Western leaders, in particular the US.

Chancellor Scholz is working with "prudence and pragmatism" to diversify trade for his country. Absent any set timelines, supporters and critics alike will be focused on 2023 to see if Germany can take further steps to fix its energy problem and address its trade dilemma. If not, then Germany can expect a long winter and a long summer.

United States: A high federal funds rate and a slowing economy (but strong job market?)

Midterm elections are done and now comes the real work for President Joe Biden. The US economy will likely slow in 2023 with GDP growth at slightly below 1 percent, compared to an estimated 2 percent in 2022 and 6 percent in 2021. Consumer spending is still expected to rise slightly in 2023 with inflation slowing to 4 percent to 5 percent. All these numbers will form the backdrop for the federal funds rate, which is expected to rise to 4.75 percent to 5.00 percent in 2023, with two hikes expected in February and March.

A high federal funds rate will maintain the slowdown in the US housing market with 30-year fixed mortgages at roughly 7 percent (compared to 3.25 percent at the beginning of 2022). That said, while not buying houses today, Americans continue to spend their excess savings built up in 2020 and 2021 as well as buy more on credit. Defaults, however, remain low despite consumer borrowing being at an all-time high. That may be a different story for the global economy where numerous central banks raise rates in line with the US federal funds rate, which may create more pressure in other economies not tied to the US.

None of these issues matter too much (at least, in the US) if Americans are employed and can ultimately pay their bills. The Biden administration will continue to emphasise the strong job market and claim there is no "true" recession (just maybe a "technical" one if that happens). Hopefully the level of slowdown and how to combat it will dominate the discussion when the time comes – the world is already sceptical of the US fractious politics yet know that decisions in the US on certain issues (such as inflation and interest rates) will continue to have global ramifications.

United Kingdom: What or who can reverse the turmoil of 2022?

The UK is tumbling (that may be a euphemistic description). The UK witnessed a record economic decline of 11 percent in 2020 followed by 7.6 percent growth in 2021. Then 2022 happened. The economy is expected to grow by 4.2 percent, and the former Chancellor of the Exchequer (under Boris Johnson) Rishi Sunak became the UK's first prime minister of Asian origin, but those may be the only two highlights for the year.

Queen Elizabeth II passed on September 8, which was the second day on the job for then-Prime Minister Liz Truss who would only last 50 days after replacing Boris Johnson. Her tenure, however, was longer than that of her Chancellor of the Exchequer Kwasi Kwarteng who lasted a mere 38 days after his budget promising large tax cuts for the wealthy triggered a major backlash from the public. The market also sent a message with the pound nearly hitting parity with the dollar in 2022 as investors dumped the currency and UK bonds. The Bank of England intervened to prevent the bottom from falling out and the IMF openly criticised the UK government on its tax plans.

So, what about 2023? The economy is expected to contract by 1.3 percent by little fault of Prime Minister Sunak. He should create political stability and bring sensibility and confidence to the office (though probably too little too late for the Tory party). An increase in labour participation and a potential reduction in inflation looks possible, which could ease the pain of an impending recession. Still, the UK looks susceptible to any external shock on a global stage and looks ultimately weakened by Brexit – I am not sure Prime Minister Sunak or any Labour Party leader can necessarily change that perspective in the short term.

Brazil: Which Lula will govern it?

Former president Luiz Inácio Lula da Silva has returned with a very close victory in the presidential runoff on October 30. Despite winning only 51 percent of the vote, Lula looks like a man ready to govern with a major presidential mandate, especially with Brazil's congress having approved an additional 168 billion reais (USD 32 billion) to be spent on social welfare programmes and other campaign promises. Leftists and environmentalists are excited by this new spending as the money will go to the pockets of Brazilians (indirectly ensuring some Covid-19 benefits become permanent) and to the protection of the Amazon (a concern low on former president Jair Bolsonaro's priority list).

But what is the plan for the greater Brazilian economy? Lula will have to govern with a very conservative legislature though the recent spending bill suggests he is off to a good start. He will have to combat inflation, which giving more "free money" to the poor will not accomplish, and will have to manage the surpluses of high commodity prices for when prices ultimately normalise again (which was not his track record in his previous presidential stint). Lula will also need to attract more foreign investment and bolster growth (now estimated to be at 2.1 percent by the economy minister) with a balance of policy between his leftist leanings and the conservative thinking of Bolsonaro. If Lula fails to kickstart South America's largest economy, it could have reverberations beyond simply Brazil.

China: Zero-covid – to be or not to be?

To say 2022 was tough for China would be an understatement. The real estate market struggled with numerous developers missing debt payments, sale of new homes floundering, and construction stalled at various sites across the country. Exports, which surged during covid, slowed as inflation tightened the pocketbooks for most consumers. Chinese companies, in particular technology companies, felt pressure from both sides with the US increasingly scrutinising Chinese-based companies, such as Huawei and Tik Tok, and China equally tightening its grips on the tech sector through increased fines and other regulatory enforcements. Lastly, a zero-covid policy consistently introduced disruption and stoppage to everyday life in Chinese cities with lockdowns undercutting both supply and demand in the local market and beyond.

In the last month, China has abruptly relaxed many of its zero-covid policies. This should automatically change the outlook for 2023 but, like other countries, China is unlikely to return to its pre-Covid lifestyles. What has changed (or may change) is not clear. Nevertheless, a new-normal that is less reflective of zero-covid and more reflective of the global "living with covid" could help rebuild local demand.

The outlook for exports and Chinese trade, however, remains challenging as other economies potentially fall into a recession. Conservative estimates have Chinese growth at 5 percent in 2023. If developed economies avoid a recession and maintain strong consumer demand, then the Chinese outlook could return to its former days. Otherwise, there is the narrative (which could become more reality) of investors exiting China due to slowing growth and increased scrutiny from the West.

India: An alternative to China?

Those investors concerned with the Chinese economy are looking to India as an alternative option for Asian exposure. On one hand, India could be a good alternative with Indian stocks up 4 percent (in local currency terms) this year compared to the 20 percent drop for global stocks. The country has a booming IT sector and a very large populace (which is becoming increasingly educated with more money to spend). On the other hand, India, simply put, is not China. First, the combined market cap of Chinese firms listed in Hong Kong and New York, which have been hammered down in 2022, is roughly USD 6 trillion while the market cap of Indian stock markets, which benefited from a positive 2022, is still nearly 45 percent smaller in size at USD 3.4 trillion.

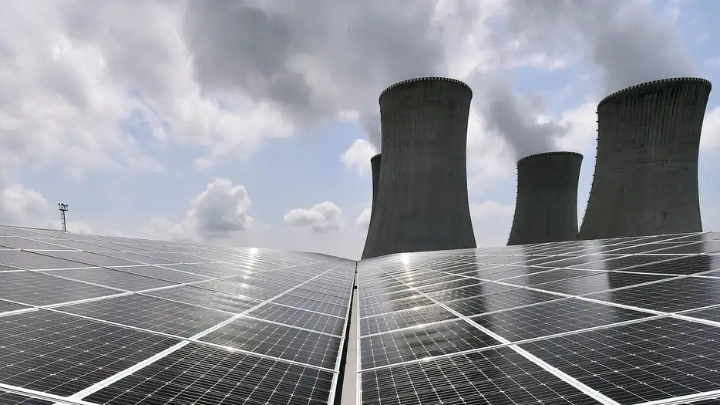

Secondly, India is a major importer of commodities, in particular oil. The country increased its import of Russian oil by 500+ percent after Russia invaded Ukraine in February. This cheaper source of oil will presumably not last forever and India will have to revisit how to fast-track its energy transition. Finance minister Nirmala Sitharaman has already made this a big piece of India's 2023 budget. Thirdly, despite some recent successes, investors still are not sold on India as a greater manufacturing hub. Some investors prefer to "wait and see" on China.

Lastly, the successes of the Adani and Ambani groups among others do not necessarily sell foreign investors on their ability to succeed there too. Can India shift international investor perspective and corporate mindsets in 2023 at greater pace than recent years? If so, India could have a big 2023 with Chinese economic light at its dimmest in a long time and investors open to consider alternatives. If not, then either India missed an opportunity, or the Chinese economy rebounded with vigour.

Nigeria: Can it regain its former momentum?

Africa's most populous country has an election in 2023 with incumbent President Muhammadu Buhari unable seek a third term. Bola Tinubu, who is 70, will lead the ruling All Progressive Congress (APC) party while Atiku Abubakar, who is 76 and lost to Buhari in the 2019 presidential election, will lead the main opposition People's Democratic Party (PDP). Fifteen other parties have also nominated candidates for this election. Early polls suggest Labour Party candidate, Peter Obi at the ripe age of 61, could be the front runner. He is the favourite among young voters who account for an overwhelming majority of the electorate (85 percent of the Nigerian electorate is younger than 35). This election, in theory, would be about addressing their concerns – primarily jobs and economic opportunities – if the main candidates were not old(er).

The economy is struggling. Economic growth is forecasted to fall to 3.0 percent in 2023 compared to an estimated 3.2 percent in 2022. These numbers would not be considered anaemic if 2022 was not the year of oil producers. Africa's biggest oil producer failed to capture the GDP growth and foreign reserves that other OPEC members saw in 2022. Nigeria lacks modernised infrastructure for production and transport and depends on oil imports for domestic needs (as the country also lacks the necessary refineries to service its local demand).

Significant money is spent by the government to provide various subsidies, which are both costly to maintain and politically difficult to remove (let alone change). The naira continues to struggle against the dollar while the government lacks dollar reserves (Emirates ultimately suspended flights to the country after it failed to release outstanding funds from ticket sales trapped in the country).

And, while Nigerians are entrepreneurial and have built an ecosystem to support their efforts, polls show that they are not happy with the existing economic systems and structures. Can the next leader meet their demands and unlock Nigeria's true potential?

Turkey: What will happen after the June election?

Another country facing a major election this year is Turkey with President Recep Tayyip Erdoğan seeking another term in the June election. The former Prime Minister has controlled the country (in some form) since 2003 when he became prime minister (until 2014) and the country was governed under a parliamentary system. He became president in 2014 and, by referendum, the country switched to a presidential system in 2017. This election is expected to be close, though this all depends on the opposition's ability to band together against President Erdoğan, whose Justice and Development Party (AKP) is currently governing in a coalition with the Turkish National Movement Party (MHP).

The economy is in complete turmoil with a consistently plummeting currency, high inflation, and nearly 70 percent of the population unable to pay for food and housing, according to a survey by Yöneylem Social Research Centre. Under President Erdoğan, there has been consistent GDP growth at an average of 5.8 percent between 2002 and 2021, yet the currency has gone from 8 Turkish lira to a dollar in September 2021 (once assumed the bottom end of valuation) to nearly 19 Turkish lira.

Inflation accordingly skyrocketed to a 25-year high of 85.5 percent, according to the Turkish Statistical Institute, in October. Some other analysts and organisations put inflation at a rate two times higher. Irrespective of what the actual number is, the economy is overheating, and recent policies have not changed the outlook. If President Erdoğan is re-elected, many investors assume things will remain the same, and if he loses, many investors assume things may change – but in what way? Only positive certainty is Turkish citizens will vote on June 18, 2023.

Argentina: Is this the year Argentina turns things around?

Like Turkey and Nigeria, Argentina has an election in 2023 with its country at a crossroads. The Argentinian economy is in tatters with inflation reaching 100 percent this year. Unemployment rose to 7.1 percent, which was its first increase since 2020, and, while the economy is still expected to expand roughly 5 percent this year, the country's vital agricultural sector may potentially contract on an annual basis due to crop drought hitting the country's exports. These numbers do not speak well for the Argentinian economy going into 2023.

Furthermore, it will take more than winning the World Cup in Qatar to bring people to the country – through October, almost 600,000 more Argentinian travellers left the country than foreigners who arrived to the country which equates to a tourism deficit for a country well known for its tourism. Lastly, the fiscal deficit is widening despite the country promising the IMF to shrink it. A troubling track record of 9 sovereign defaults luckily has not kept investors away (but how long before investors give up?).

So, why is this a country to watch? This is South America's second largest economy, and something must change. Nothing like a year of campaigning in a country that has mandatory voting to start that process. Three coalitions currently dominate Argentinian politics: the centre-left Frente de Todos ("Everyone's Front"); the centre-right Juntos por el Cambio ("Together for Change"); and the populist-libertarian La Libertad Avanza ("Freedom Move Forward"). Incumbent President Alberto Fernández of Frente de Todos says he will seek re-election. He may face a challenge from his Vice President Cristina Fernández de Kirchner, who was president from 2007 to 2015, but, after being convicted on corruption charges in December, sentenced to six years in jail, and barred from holding public office, she will have to pull a "Lula" (i.e., have her convictions annulled).

The candidate for Juntos por el Cambio is not clear with a few members fighting for the nomination and it is widely expected that La Libertad Avanza will nominate Javier Milei, an economist who raffles off his legislative salary every month to protest what he calls government theft. Milei has been compared to Donald Trump and Jair Bolsonaro for his critics on the Argentinian ruling class and pledge to move away from the leftist policies that have controlled the country for decades.

Whoever wins this election, especially if not the incumbent, will have to make drastic policy changes to jumpstart an economy expected to grow less than 1 percent in 2023 (or even potentially contract).

United Arab Emirates: Will it demonstrate its resilience (and creativity) again?

The UAE continues to demonstrate resilience. Expo 2020 provided the early boost to the economy to kickoff 2022 and the country has maintained that momentum throughout the year. The World Cup in Qatar was a boon for the UAE economy as fans chose Dubai as their favourite base destination for attending the games along with being a favourite location for holiday. Dubai is also a favourite destination for remote work and the country is offering various visas to facilitate foreigners making the UAE home. Dubai real estate accordingly is growing at one of the fastest rates in the world with numerous millionaires and billionaires flooding into the city.

In Abu Dhabi, sovereign wealth funds and other government related entities are investing globally and locally with government coffers plentiful from strong oil prices. Because of local investment, the non-oil sector of the UAE economy is expected to grow 3.9 percent compared to 2.7 percent growth for the entire economy. Critics are running out of criticisms for the economic success in the desert by Emirati leadership. Though it is fair to question whether others can imitate the UAE or, at least, capture similar economic momentum.

Other touristy destinations, such as Indonesia and Thailand, are unlikely to become financial hubs and also have not seen the same level of return with foreign visitors, while other regional financial hubs, such as Hong Kong and Singapore, are not exactly becoming touristy spots. Still, the UAE is a must-watch, if not solely as an indicator of how those with money or those facing conflict are choosing to set up their life and navigate the world.

-Daily Star

-Kurt Davis Jr, is an investment banker focused on developed and emerging markets. He is a member of the Council on Foreign Relations.

Shining BD