Concerns of economic crisis during Ramadan

DailySun || Shining BD

Economic and business analysts have expressed concerns that the country could face significant challenges during the upcoming Ramadan. Political instability and reduced imports due to various complications have created uncertainty in meeting heightened consumer demand, they warn. Analysts recommend pragmatic measures to overcome these hurdles and encourage entrepreneurs to revive economic activity.

Abul Kasem Khan, former president of the Dhaka Chamber of Commerce and Industry (DCCI), said, "Political changes have impacted every aspect of business and commerce, leaving entrepreneurs uneasy. The government must engage more closely with business stakeholders to foster a business-friendly environment and create frequent dialogue opportunities."

Over the past few years, the country's economy has been sluggish due to several factors. The COVID-19 pandemic, coupled with the economic downturn caused by the Russia-Ukraine war, has impacted Bangladesh. Rising costs of energy, raw materials, and equipment, coupled with the sharp devaluation of the Bangladeshi Taka against the US dollar, have severely disrupted business operations. Additionally, a lack of access to loans, exacerbated by unprecedented banking sector corruption, has prevented genuine entrepreneurs from securing necessary funding. Large investments in industries have been stalled due to unavailability of gas and electricity, hindering production and the scaling up of food and commodity production to meet increasing demand.

Despite political changes following Sheikh Hasina's fall on 5 August, the business environment has not improved significantly. Entrepreneurs and industrialists continue to face mounting pressures, such as high-interest loans, energy crises, and law enforcement issues. These challenges have halted production recovery, leaving many reluctant to invest further. Instances of factory raids, harassment lawsuits, frozen bank accounts, travel bans, and baseless allegations have instilled fear among business owners.

Revisions in banking loan regulations have worsened the situation. Longtime compliant borrowers are now struggling under these new rules, with even successful companies being labeled as defaulters due to technicalities. For instance, if one subsidiary of a business group defaults, the entire group faces restrictions on obtaining new loans, causing operational bottlenecks, especially in opening Letters of Credit (LCs) for imports.

Businesses importing raw materials through Usance Payable at Sight (UPAS) LCs are also facing difficulties. Under this system, importers have 270 days to pay suppliers after selling processed goods in the market. However, the steep rise in the exchange rate for the US dollar has created complications in paying off suppliers. Banks are demanding payments at the current exchange rate, causing importers losses of up to 20%. Businesses have called for converting UPAS LCs into long-term loans to ease their burden. Without such measures, many LCs could default, potentially doubling the sector's non-performing loans.

The challenges with previous UPAS LCs and losses from sold products have discouraged many from importing new raw materials. This uncertainty in supply chains has raised concerns over shortages of essential commodities during Ramadan, with the Bangladesh Trade and Tariff Commission (BTTC) also issuing warnings.

BTTC reports show a sharp decline in imports of vital commodities during July-October 2024 compared to the previous year. For example:

Crude sugar imports dropped by 367,591 tons.

Palm oil LC openings fell by 77,930 tons, with actual imports down by 174,386 tons.

Soybean seed imports reduced by nearly 33,000 tons.

These reductions have compounded the risk of supply shortages in Ramadan unless immediate and realistic initiatives are taken.

To address the situation, the Tariff Commission has suggested reducing interest rates on loans for importing essentials and ensuring uninterrupted gas and electricity supply to mills processing edible oil, sugar, and lentils. However, many businesses with substantial investments in industries are unable to commence operations due to gas shortages. For instance, a large soybean oil mill with a daily production capacity of 1,000 metric tons remains non-operational despite fulfilling payment obligations to the gas authority.

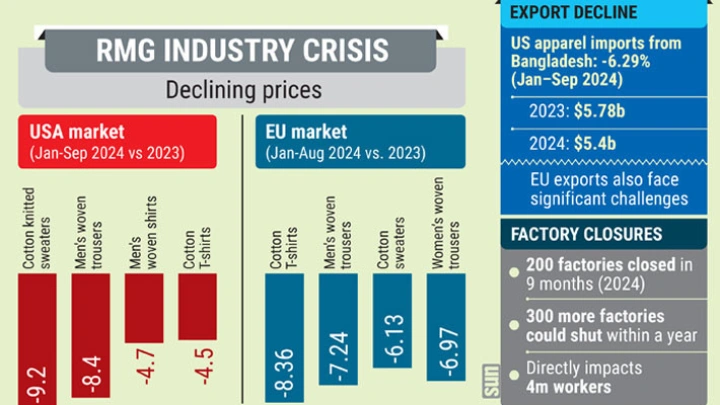

Rising gas prices, now three times higher, have significantly increased production costs. Many industries, including ready-made garments, have closed, leaving businesses unable to repay loans or sustain operations.

Entrepreneurs feel constrained by these challenges, struggling to maintain operations. If the situation does not improve soon, it could severely impact the overall economy. Businesses failing to operate normally risk leaving millions unemployed, while reduced activity would diminish government revenue.

Commenting on the crisis, Professor Moinul Islam, former president of the Bangladesh Economic Association, noted, "Encouraging investments is key to revitalizing the economy, but it will take time. The previous government’s mismanagement and corruption have severely damaged the economy, with billions of dollars siphoned out of the country. We must endure the cumulative effects of these actions for a while longer, as there is no quick fix."

Shining BD