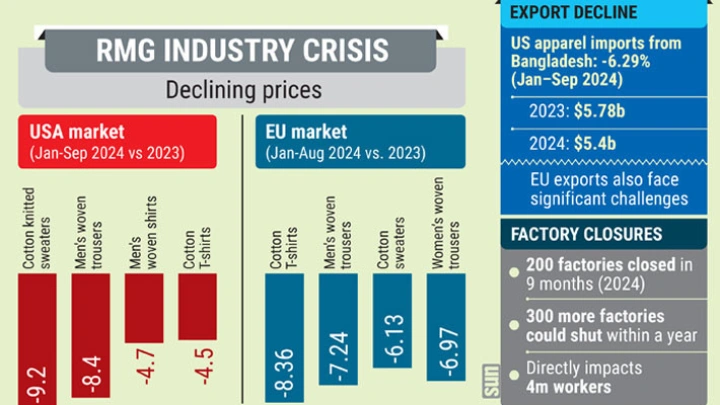

Buyers demand more, pay less

DailySun || Shining BD

Bangladeshi ready-made garment (RMG) manufacturers find themselves in a growing dilemma: while international buyers demand stricter compliance with labour rights, including wage hikes and improved working conditions, they, especially those from the US and EU, simultaneously offer lower prices for goods. This contradiction is placing immense pressure on the industry, raising concerns about its sustainability and future viability.

Exporters have expressed grave concerns over the falling prices, warning that this trend could severely undermine efforts to ensure compliance with labour rights.

They also predict the potential closure of around 300 factories within a year, alongside a decline in the country’s overall export revenues.

The local RMG makers claimed that currently the buyers of USA offer overall 5%-8% less prices while EU buyers offer 6%-7% less compared to previous prices.

According to the Office of Textiles and Apparel (OTEXA) undertakes industry analysis, contributes to US trade policy development, the price of cotton knitted sweater declined 9.2% in piece in USA market in January to September of 2024 compared to its corresponding previous period.

The price of M/B cotton woven Trouser declined 8.4%, the price of M/G cotton woven Trouser declined 4.8%, the price of M/B cotton woven Shirts declined 4.7%, the price of cotton knitted T-Shirts declined 4.5% in the same period, the data also showed.

The data showed that the US apparel imports from Bangladesh declined 6.29% in January to September in 2024 compared to the same corresponding period last year. Bangladesh exported RMG products valued total $5.78 billion in January to September in 2023 which figure was $5.4billion in 2024. It accounts 5.51% negative in FY23 compared to last fiscal year.

On the other hand, in EU markets, the price of cotton knitted T-Shirts declined 8.36% in kg in January to August in 2024 compared to its corresponding previous period, according to Eurostat, the statistical office of the European Union.

The price of M/B cotton woven Trouser declined 7.24%, the price of cotton knitted sweater declined 6.13% and W/G cotton woven trouser reduced 6.97% in the same period, the data also showed.

According to Export Promotion Bureau, Bangladesh exported total $55.56 billion in fiscal year 2023. Of this, the RMG sector earned $47 billion in the fiscal year. Bangladesh exported $23.53 billion in EU countries in the fiscal year 2023 while the country earned $8.5 billion in USA market.

Bangladesh’s RMG exports to fall, 300 factories may shut by one year

Speaking to the Daily Sun, Sparrow Apparels Ltd Managing Director Shovon Islam said he has been exporting RMG products in both EU and USA for long years.

“We are very concerned and facing severe challenges as the buyers offer less prices now amid high production costs, and fulfilling the 18-point demands from labours. The tight monetary policy, higher energy cost, wages, and bank interest rate created much challenges for us,” he also said. Shovon, one of top-10 exporters in the country, said buyers know about the destabilization situation goes on in Bangladesh so they offer lower prices. They are trying to take the advantages.

“Many letters were sent by BGMEA to the buyers to increase prices to ensure compliance but they reduce the prices amid high manufacturing costs. We fear of declining overall exports in coming days. In the last nine months, 200 factories have been shut. Additional around 200-300 factories may shut due to the falling prices,” he claimed.

There are more than 2000 RMG exporters in Bangladesh. And 40 lakh employees are directly working in the industry. “Now workers are demonstrating at several factories as the factories cannot afford to pay salaries due time. Amid the situation, the falling prices of the country’s RMG products will make another challenge. Sadly, we don’t get enough support from the government. The apex apparel trade body cannot operate led by an administrator,” he highlighted.

Factories face a constant struggle to balance operational costs

Mohiuddin Rubel, former director of Bangladesh Garment Manufacturers and Exporters Association (BGMEA), said falling prices for Bangladeshi garments raise sustainability concerns.

As the industry expanded, so did the cost of doing business. Over the past five years, production costs have surged by a staggering 50%, he said.

He highlighted that this increase stems from a combination of factors – rising wages, escalating utility expenses, and a sharp uptick in raw material prices. Bank interest rate also gone up, while costs like airfreight has increased exorbitantly in recent months. Factories face a constant struggle to balance operational costs without compromising competitiveness.

“Buyers are not paying us fair prices. Workers’ wages have increased, we have to comply, but they are not increasing prices accordingly. Global clothing prices have also decreased. Competing exporters are also going up competition. Buyers will want to give us lower prices, but sometimes we ourselves are reducing prices in the name of competition to fill our capacity. Overall, the prices of our clothing products in the US and EU markets have decreased,” he said.

Mohiuddin, also additional managing director of Denim Expert Limited added that as Bangladesh continues to lead in sustainability efforts, fostering a collaborative mindset across the supply chain is vital. Buyers, manufacturers, and stakeholders must work together to align expectations and ensure that the value created through responsible practices is reflected in pricing structures.

According to him, the garment industry is poised for a brighter, more sustainable future. By addressing challenges holistically and working collaboratively, stakeholders can create an environment where both sustainability and fair compensation thrive--paving the way for shared growth and success.

Collaborative action, systemic support crucial to secure fair pricing, protect RMG industry

According to another entrepreneur of the sector Md Salauddin, “We need to work out something to get better fair price, Since COVID-19, Bangladeshi exporters have faced compounded challenges, from political unrest to a mounting burden of bank loans. These obstacles have severely weakened their ability to negotiate or secure fair prices.”

He added that a critical issue is the lack of reliable market data and analysis, leaving entrepreneurs without the tools to predict trends or make informed decisions.

“To overcome these barriers, a unified effort from industry leaders and policymakers is crucial. Establishing data-driven strategies and enhancing market insights can empower exporters to bargain effectively. Collaborative action and systemic support are needed to secure fair pricing and protect the RMG sector’s future.”

To address this, industry owners, policymakers, and buying agents must unite to ensure fair pricing. Collaboration across the supply chain and firm policies to uphold responsible practices are essential, he concluded.

Shining BD