The move targets a major source of funding for the Kremlin’s war in Ukraine

G-7 nations say they will cap the price of Russian oil

Shining BD Desk || Shining BD

The leaders of the Group of Seven industrialized nations announced Friday that they will impose a price cap on Russian oil, aiming to undercut the Kremlin’s finances while keeping the energy flowing to the West.

The price cap plan, a top priority of U.S. Treasury Secretary Janet L. Yellen, aims to slash the huge energy profit Russia is using to finance its war in Ukraine without creating price shocks that could cripple the global economy.

The G-7 had previously agreed only to explore the price-cap proposal, but its declaration Friday was its most significant statement to date that the nations would seek to enact an aggressive new policy, which would be an unprecedented, internationally coordinated action on energy prices.

Top Russian leaders have repeatedly warned that they will retaliate against the price cap. Europe remains highly dependent on Russian energy, and an escalation in hostilities could exacerbate the economic crisis already facing the Western allies.

“Today’s action will help deliver a major blow for Russian finances and will both hinder Russia’s ability to fight its unprovoked war in Ukraine and hasten the deterioration of the Russian economy,” Yellen said in a statement Friday. “We have already begun to see the impact of the price cap through Russia’s hurried attempts to negotiate bilateral oil trades at massive discounts.”

The G-7 nations — the United States, five of its Western allies and Japan — said in a statement that they plan to enact the price cap by cutting off insurance for all shipments of Russian oil that are sold above a certain price. That would effectively would make it impossible to ship cargoes priced above the cap. The cap price has not yet been announced but is expected to go into effect by December, when the shipping ban also is expected to take effect.

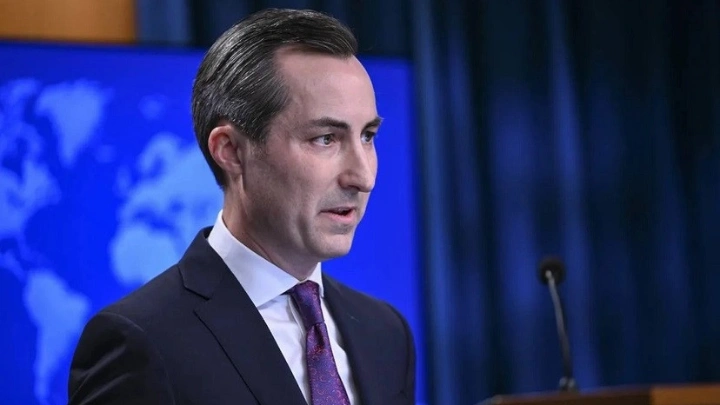

White House touts G-7 plan for Russian oil price cap

White House press secretary Karine Jean-Pierre on Sept. 2 said that G-7 countries would set a price cap level on Russian oil in the coming weeks. (Video: The Washington Post)

Yellen has pushed the policy for months with her international counterparts but faced skepticism and difficult questions about exactly how the price cap would work. Analysts have raised concerns that the cap could be circumvented if countries outside the G-7 — such as China and India — continue to buy Russian oil at a higher price and then sell it back to world markets at a premium. Other analysts and foreign leaders have expressed concern that Russia could retaliate by even more sharply limiting its shipments of natural gas to Europe, which already faces a winter in which Germany and other nations will experience critical shortages of energy supplies.

Despite the recent decline in energy prices, Russia has continued to reap hundreds of billions of dollars from its sales of oil and natural gas. Those energy sales have dramatically undercut the West’s sanctions campaign imposed over Russia’s invasion of Ukraine, stabilizing the Kremlin’s finances and giving it the means to continue the war.

Energy analysts said Friday’s announcement does little to clear up how the cap will affect international gas and oil prices, noting that critical details — such as the level of the price cap and the date it will take effect — have not been announced.

“The devil is in the details, and few details appeared today,” said Bob McNally, a former energy official in the George W. Bush administration now at the Rapidan Energy Group. “This was a process announcement, moving from exploring a price cap to implementing one.”

Senior Treasury officials told reporters on a call on Friday that the allies will set the price cap above the cost of production for Russia, so oil continues to flow to world markets. The officials said they will work to bring other European countries and major economies into the plan. Even if countries including India and China do not join the price cap, Treasury officials said, the existence of the cap will give other nations greater leverage in negotiations with Russia over their energy contracts, which should help accomplish the goal of driving down the Kremlin’s revenue. Treasury officials said they have been told by other nation’s leaders that they are already benefiting from the price cap plan because Russia knows it has diminishing numbers of potential buyers.

Yellen also has emphasized that the price cap would prove less disruptive to global energy markets than the ban on all Russian oil that Europe has been preparing to implement by the end of the year. In June, after weeks of tense negotiation, the European Union agreed to ban imports of oil from Russia and prohibited insuring and financing of the maritime transport of Russian oil to third countries. The United States banned imports of Russian oil in March.

Janet Yellen's global campaign to defund Vladimir Putin's war machine

To implement the cap, the G-7 will have to get E.U. member states to amend the bloc’s sixth round of sanctions. The oil cap news comes as the E.U. considers emergency measures to tackle soaring energy prices and prepares for what many fear will be a long, cold winter. E.U. energy ministers will meet in Brussels on Sept. 9 to discuss calls to overhaul the bloc’s energy market.

Concerned about the potential for soaring prices, U.S. officials have pushed hard for the cap but faced resistance in Brussels, where some E.U. diplomats have maintained that the cap needs much broader support, particularly from China and India, to be effective.

Dmitry Peskov, a spokesman for Russian President Vladimir Putin, warned Friday that countries that participate in the price cap will not receive Russian oil. Peskov said of the Western allies: “We simply will not cooperate with them on oil on such nonmarket principles.”

Asked about the Kremlin’s threats, a senior Treasury official said Russia is desperate for energy revenue and called its credibility into question, pointing out that Russian officials also said they were not going to invade Ukraine.

Ariel Cohen, a senior fellow at the Atlantic Council, said he remains concerned that Putin will respond to the price cap by cutting Europe off from natural gas shipments, which could exacerbate the continent’s economic crisis.

“We have to be careful in not causing an economic slump in Europe,” Cohen said. “I want to understand clearly where the alternative gas supply will come from. What is the extent of the economic pain Europe can take?”

But Simon Johnson, a professor at the Massachusetts Institute of Technology who specializes in energy policy, emphasized that the price cap plan — which would still allow Russia to trade oil at a discount — would be less disruptive to world markets than Europe’s prior plan to cut off all imports of Russian oil.

“It demonstrates that they want the oil to flow, which will keep oil prices lower than they would be otherwise,” Johnson said.

Source - Washington Post

Shining BD