Per capita income tops Tk3 lakh for first time

DailySun || Shining BD

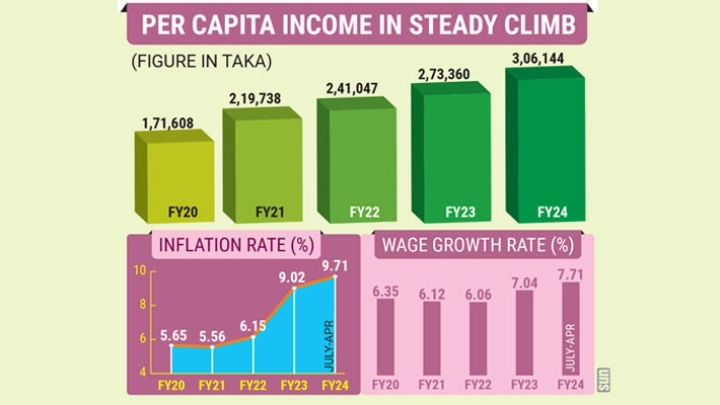

Bangladesh has reached a significant milestone as its per capita income has shot to $2,784, exceeding Tk3 lakh in local currency for the first time in its history.

However, this average income growth does not reflect a real rise in people’s purchasing capacity due to inflation, devaluation of taka, and income disparity, economists have said.

The latest data released by the Bangladesh Bureau of Statistics (BBS) reveals a steady increase

in the country’s average per capita income despite the challenges posed by the dollar appreciation.

The provisional figures for the current fiscal year underscore a remarkable growth trajectory, with the per capita income calculated based on a dollar price of Tk109.97. Moreover, in a noteworthy development, the average annual income per capita has exceeded Tk3 lakh, standing at Tk3,06,144.

This significant uptick in per capita income is reflective of Bangladesh’s economic resilience and robust growth trajectory, said economists.

BBS’s release of provisional estimates encompassing gross domestic product (GDP), growth, investment, and per capita income for the ongoing financial year reinforces the nation’s steady economic progress.

Compared to the preceding fiscal year (FY23), when the per capita income stood at $2,749, the current increment of $35 highlights a positive trend in economic prosperity.

Previous figures also show a steady climb: Tk2,73,360 in FY23, Tk2,41,047 in FY22, Tk 2,19,738 in FY21, and Tk1,71,608 in FY20, with corresponding dollar values of $2,749 in FY23, $2,793 in FY22, $2,591 in FY21, and $2,024 in FY20.

BBS also forecasts a growth rate of 5.82% for GDP in the current fiscal year, up from 5.37% in the previous year, indicating a sustained economic momentum.

‘Per capita income rises, not purchasing power’

It is important to note that per capita income represents the country’s total income, including remittances, divided by its population, providing a crucial metric for assessing the nation’s economic well-being. However, it might not necessarily mean that people’s purchasing power has also increased along with the growth in this regard, said experts as well as economists.

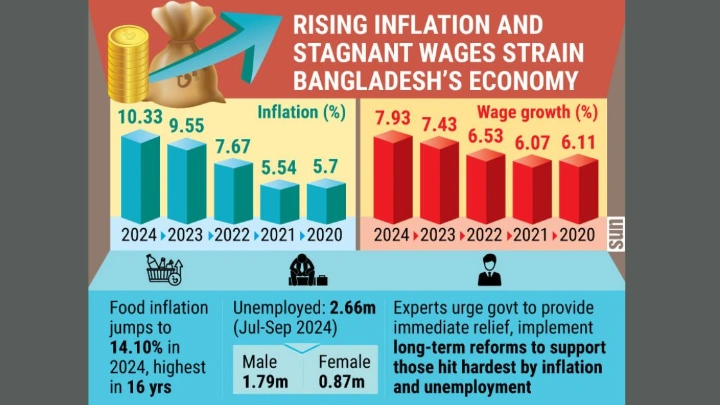

At present, millions of individuals confront daily hardships due to the escalating prices of essential goods and other living expenses. Many people’s wages have also remained stagnant for some time now, exacerbating their financial predicaments.

An analysis of the Bangladesh Bureau of Statistics (BBS) data reveals that people’s expenditures are rising at a faster rate than their wages.

During the July-April period of the current fiscal year, the average inflation rate stood at 9.71%, exceeding the average wage growth rate of 7.71%. This trend has persisted over the last four years, with the inflation rate doubling while people’s income growth was slow.

The inflation rate in the country was 5.56% in FY21, 6.15% in FY22, and 9.02% in FY23, respectively, while the wage growth rate was 6.12% in FY21, 6.06% in FY22, and 7.04% in FY23, respectively.

There is approximately a 2% gap between the inflation rate and the wage growth rate, according to the BBS data. The inflation rate, however, is rising at a faster pace compared to the wage growth rate.

Prof Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue (CPD), told the Daily Sun that although the per capita income has shown a slight increase in terms of the taka, there has not been a significant increase when it is considered in terms of the dollar.

Besides, the Bangladesh Bureau of Statistics provides an average figure for the nation, but there is a significant income disparity between the rich and the poor, he said.

“Additionally, there has been about 20% inflation in the country over the last two years. Therefore, when considering income inequality and inflation, the actual income has not increased much,” Rahman informed.

He emphasised the urgent need to control inflation to mitigate the declining purchasing power of the people, especially those with fixed incomes. Inflation should be brought below 8% to alleviate the financial burden on citizens, he said.

“The decreasing purchasing power has led individuals to adjust their expenditures by cutting costs on essentials such as rent, food, and education,” said Prof Mustafizur Rahman, adding that the government should implement initiatives aimed at bolstering investments and production.

Shining BD