Businesses are being gradually destroyed

DailySun || Shining BD

Following the political transition, uncertainty has taken hold of Bangladesh’s business sector, leaving entrepreneurs deeply concerned. Government actions have fueled fear and instability, prompting many industrial groups to shut down factories, while the emergence of new industries has stalled. Additionally, there are allegations of deliberate moves to turn businessmen into defaulters.

Experts believe restoring business confidence is crucial for boosting investment and employment. Following the political shift, uncertainty has increased among business owners. Business leaders have called for an end to the practice of filing unnecessary lawsuits against them. Alongside reducing interest rates, they also demand relaxation in loan default regulations.

During the crackdown on student protests over quota reforms in mid-July, when the government imposed curfews and shut down the internet, export and industrial sectors suffered significant losses. After the fall of the Sheikh Hasina government on 5 August, factory vandalism, protests, and attacks became rampant, resulting in numerous factory closures nationwide.

Despite some improvements, law and order remain unstable. Many business leaders complain of harassment, including freezing bank accounts and seizing assets. Entrepreneurs are also facing travel bans and harassment at airports, with some even being detained. These factors are discouraging new investments and driving industrialists to cease operations, worsening the overall business climate.

Banking Sector Challenges

BKMEA President Mohammad Hatem has emphasised the need for a "zero-tolerance" policy on lawlessness. He criticized the rise of lawsuits targeting businessmen over personal disagreements. He also pointed out that disorder in the banking sector is another hurdle. Exporters are not receiving timely payments, and factory wages are becoming difficult to pay.

The situation has worsened with the International Monetary Fund's (IMF) new loan conditions, which require loans to be classified as defaults if not repaid within three months after the due date, a significant reduction from the previous six-month grace period. This, coupled with rising interest rates, has led to a 16-17% interest burden, reducing private sector loan growth.

According to Bangladesh Bank, private sector loan growth in June 2023-24 fell to 9.84% compared to 10.58% the previous year. Loan disbursement and import activities have also slowed. In the first two months of the current fiscal year, the opening and settlement of letters of credit (LCs) for imports dropped by nearly 13%.

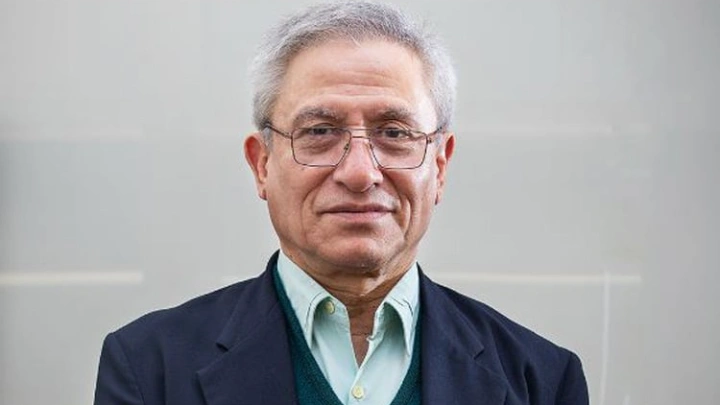

On this matter, Zahid Hossain, former Chief Economist of the World Bank's Dhaka office, said that political transitions have created a sense of uncertainty in the business sector. Business owners are concerned about the direction politics will take over the next year or so and are also considering who might come to power. To boost investment and employment, rebuilding business confidence is essential.

Syed Nasim Manzur, former president of the Dhaka Metropolitan Chamber of Commerce and Industry, highlighted that businesses cannot thrive under double-digit interest rates, which now exceed 14%.

Abdul Muktadir, chairman of Incepta Pharmaceuticals, warned against industrial instability, stressing that even small businesses are suffering severe financial strain.

Farooq Hassan, former president of BGMEA, explained that many businesses lack sufficient personal funds, relying on partnerships and family investments. If one entity defaults, banking services for all associated businesses are suspended, causing widespread financial distress.

Hassan also criticized the rising interest rates, arguing that in Bangladesh, where large companies dominate borrowing, higher rates inflate production costs, ultimately stifling investment and job creation.

Business leaders warn that without immediate intervention, the situation may deteriorate further, with no signs of recovery in sight.

Shining BD