Leather, shipbreaking, RMG among top loan defaulting sectors

DailySun || Shining BD

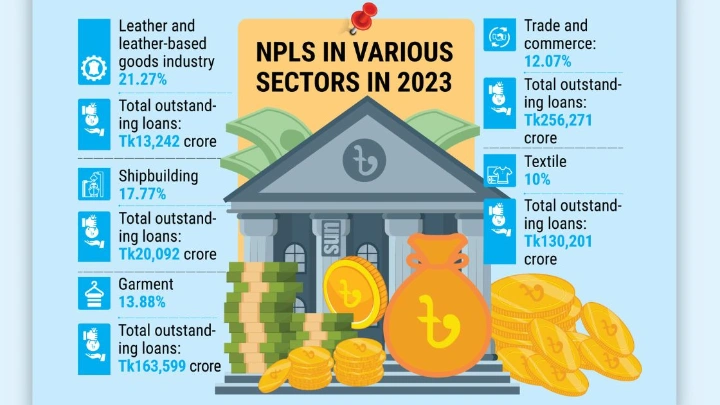

Leather, shipbreaking and shipbuilding, readymade garment, trade and commerce, and textile are the top five sectors that generated the highest level of defaulted loans in Bangladesh in 2023, according to the central bank data.

The leather and leather-based industry sector had the highest level of non-performing loans (NPLs), which accounted for 21.27% of the total outstanding loans of Tk13,242 crore as of December last year.

As of December last year, banks gave out funds amounting to Tk20,092 crore in the shipbuilding and shipbreaking sector. Of the volume, 17.77% turned into NPLs, the second highest ratio among all of the sectors.

The garment industry is another sector where a considerable volume of loans has fallen into the defaulted category, the third highest. The ratio of NPLs stood at 13.88% against the outstanding loans of Tk1.63 lakh crore.

Mohammed Hatem, president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), told the Daily Sun that the defaulted loans will double as the business is not possible if the circular given by Bangladesh Bank during the previous government is accepted.

In the prescription of the International Monetary Fund (IMF) and the World Bank, they have stipulated that a loan must be defaulted if one installment is not paid, he said, adding that the period for this was previously six months.

“There is no doubt that 90% of the businessmen in the country will default due to this directive from next March. In this way, the businessmen of Bangladesh are being strangled.”

Hatem said, “If this continues, everyone will become a defaulter. And if there is a default, that money can no longer be collected. If they do not give me the opportunity to do business, then how will I repay the loan?”

Bangladesh Bank said that considering the loan exposure share and NPL concentration, the asset quality of the leather and leather-based Industry and shipbuilding and shipbreaking sub-sectors may not pose a significant stability threat to the overall system.

On the other hand, the gross NPL ratio of RMG with relatively higher loan exposure and NPL concentration could become a significant driving factor for the asset quality of the Industrial (manufacturing) sector and the banking industry as a whole.

According to the data, at the end of 2023, the trade and commerce sector’s outstanding loans stood at Tk2.56 lakh crore, while NPL was 12.07% of the outstanding loans.

As the volume of loans outstanding in the trade and commerce sector was nearly one-sixth of the total loans, it could be a concern for the overall banking sector from the stability point of view, Bangladesh Bank added in the report.

Banks’ disbursed loans in the textile sector stood at Tk1.30 lakh crore, which is 10% of the loans defaulted.

At the end of December 2023, the banking sector’s gross NPL ratio reached 9%, recording a minor increase from 8.16% of the previous year 2022.

It is noteworthy that gross NPL in the banking sector increased by Tk24,977 crore and reached Tk16.17 lakh crore at the end of December 2023, whereas the total outstanding loans and advances increased by Tk1.39 lakh crore.

The central bank said that the asset quality of the banking sector might have deteriorated partly due to lack of oversight on regular and rescheduled or restructured loans and advances as well as slow progress in NPL recovery.

Also, external problems like the ongoing Russia-Ukraine war, Israel-Palestine conflict, and other global and domestic challenges may have impaired the borrowers’ repayment capacity, which in turn might have translated into worsening of asset quality in the banking sector.

Shining BD