International MSME Day

Smart solutions: Overcoming loan hurdles, skills dearth in SMEs

DailySun || Shining BD

Despite government initiatives, small and medium enterprises (SMEs) in Bangladesh continue to struggle to access financing, hindering their growth and contribution to the economy.

Starting a business requires capital, and loans are often the lifeblood of new ventures. However, obtaining a loan from a bank poses various difficulties.

“It is often said that getting a bank loan is easy, but in reality, there are many problems when taking a loan. If you take a loan, you have to start paying installments from the very month you receive the loan – meaning you must start paying back money before investing it in the business. If this is the case, how will entrepreneurs be created?” said Tahmina Ahmed Banee, owner of Banee’s Creation and Banee’s Academy, told the Daily Sun.

Debashish Sarkar, an entrepreneur in bamboo and cane products, added that loans from local NGOs come with high-interest rates.

“We want to export our products directly to foreign countries, but getting finance for our business is a big problem for us. If the government cooperates in this matter, it will be beneficial for us to provide funds,” he said.

Small entrepreneurs need financing from banks, but SMEs are not getting the necessary support. This issue of financing is still a major problem. Despite many formalities, the actual beneficiaries are not receiving it, and those who do face interest rates of 14%-16%.

Md Arfan Ali, a renowned banker and former president and managing director of Bank Asia, told the Daily Sun, “Some truths exist in entrepreneurs’ complaints. The operating cost is very high in disbursing CMSME loans. Verification, accounting, monitoring, disbursement is not possible to meet these expenses with small loans. Banks do not profit from this.

“The process for corporate loans is the same as for CMSME loans, but a corporate loan is equivalent to fifty SME loans. Banks are not interested because of this.”

The Bangladesh Bank has increased loans to this sector through many circulars, he noted, adding, “But if the business model does not change, the banks will not be interested.”

Additionally, banks cannot give loans because entrepreneurs cannot provide necessary documents. Many entrepreneurs need to be transparent and provide the required information to take the loan, but many are reluctant to do so. On the other hand, corporate loan defaults are high. As a result, banks may be encouraged to offer more SME loans in the future.

Tahmina Ahmed Banee also pointed out that entrepreneurs lack adequate support. In many cases, the benefits do not reach the actual entrepreneur.

“While there is much training provided, becoming an entrepreneur in just 5-6 days is not easy. The same person attends training in jute, leatherwork, baking, cooking—all subjects. However, there is no monitoring of which subject they will become an entrepreneur in. Taking the certificate after training does not confirm that someone has become an entrepreneur.”

However, with the cooperation of the SME Foundation, the Palli Karma-Sahayak Foundation (PKSF) has taken initiatives to diversify products, develop designs, improve marketing techniques, provide opportunities to participate in fairs, connect sellers with buyers, and assist in getting loans.

Dr Md Masudur Rahman, chairperson of SME Foundation, told the Daily Sun, they are currently working on development in 70 clusters identified from about 200 clusters.

“We have provided them training to improve the quality of their products and diversify them. We also linked them with the market for product sales. Small business owners, especially women entrepreneurs, face significant challenges. We are working to remove the finance problems of women entrepreneurs, create access to the market, and increase productivity,” he said.

Dr SM Faruk-Ul-Alam, value chain specialist (PACE) of PKSF, told the Daily Sun, “We have arranged advanced training for the entrepreneurs of different sectors to develop to their fullest potential. We are also providing technical assistance to the entrepreneurs.”

Ebnul Alam Palash, head of MSME Business, Prime Bank PLC, said access to finance remains a critical challenge for entrepreneurs in the CMSME sector, despite significant support from government and private sectors. Key barriers include limited access to financial facilities due to issues such as inadequate legal identity and necessary business documentation.

Moreover, CMSMEs often lack sufficient data for effective credit assessment by financial institutions, further complicating access to loans. Addressing these challenges requires collaborative efforts to enhance financial inclusion and tailor financial products to better serve CMSMEs, fostering their growth and contribution to the economy, he added.

Loan disbursement to CMSMEs

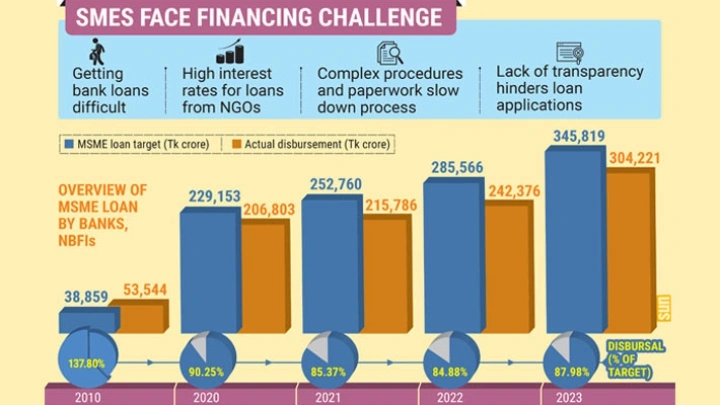

In 2010, for the first time, banks and financial institutions themselves set targets for the cottage, micro, small, and medium enterprises (CMSMEs) sector as part of the economic development agenda. In 2010, loans to the CMSME sector were Tk53,544 crore. That year the target was Tk38,859 crore.

According to Bangladesh Bank data, in 2020 banks and non-bank financial institutions disbursed loans amounting to Tk206,803 crore, while the target was Tk229,153 crore. In 2021, banks and NBFIs disbursed loans amounting to Tk215,786 crore, while the target was Tk252,760 crore. In 2022, banks and NBFIs disbursed loans amounting to Tk242,376 crore, while the target was Tk285,566 crore. At the end of 2023, banks and NBFIs disbursed loans of Tk304,221 crore, while the target was Tk345,819 crore.

The banks are increasing these loans due to the central bank’s instructions to give 25% of the total loan portfolio to the CMSME sector by 2024 and the target for disbursement of CMSME loans.

Shining BD